Question: Explain everything on how to calculate This question has two sub-questions and the data of the portfolios is given in the table below. Assume that

Explain everything on how to calculate

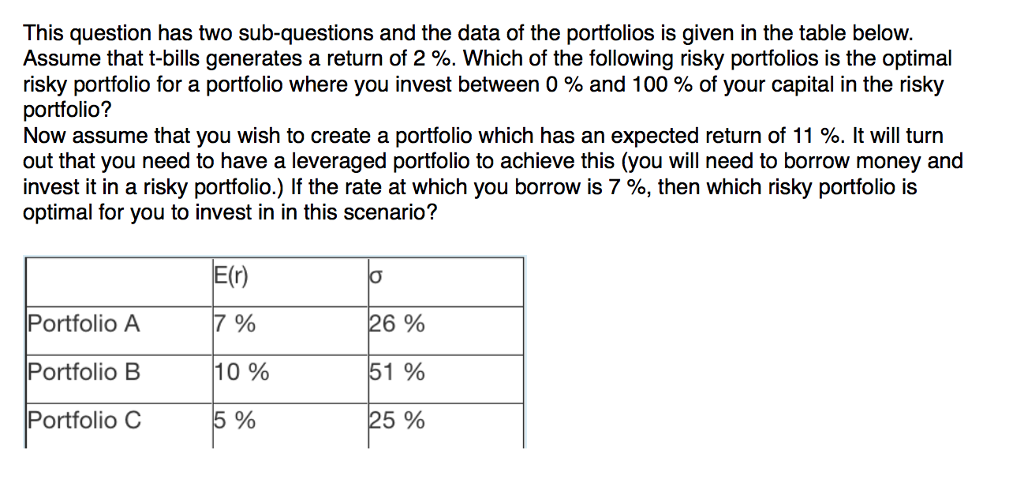

This question has two sub-questions and the data of the portfolios is given in the table below. Assume that t-bills generates a return of 2 %. Which of the following risky portfolios is the optimal risky portfolio for a portfolio where you invest between 0 % and 100 % of your capital in the risky portfolio? Now assume that you wish to create a portfolio which has an expected return of 11 %. It will turn out that you need to have a leveraged portfolio to achieve this (you will need to borrow money and invest it in a risky portfolio.) If the rate at which you borrow is 7 %, then which risky portfolio is optimal for you to invest in in this scenario? Portfolio A Portfolio B Portfolio C E(r) 7% 10% 5% 26 % 51 % 25 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts