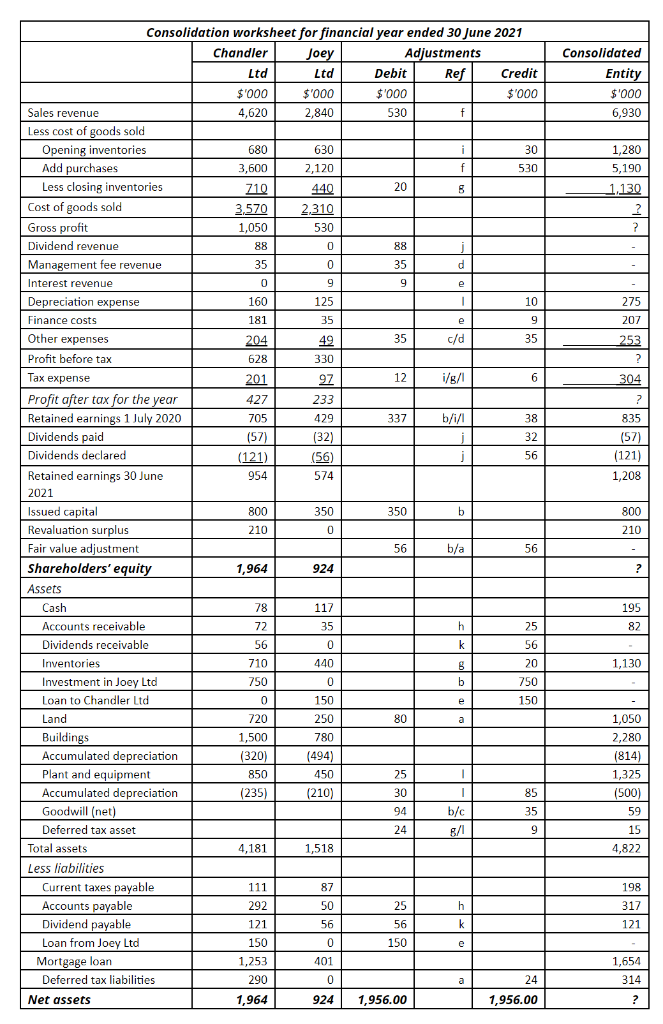

Question: Explain how and why you calculated the post-acquisition contribution made by the subsidiary to the group Consolidated Entity $'000 6,930 1,280 5,190 1.130 2 ?

Explain how and why you calculated the post-acquisition contribution made by the subsidiary to the group

Consolidated Entity $'000 6,930 1,280 5,190 1.130 2 ? e 275 e 207 253 ? 304 ? 835 (57) (121) 1,208 Consolidation worksheet for financial year ended 30 June 2021 Chandler Joey Adjustments Ltd Ltd Debit Ref Credit $'000 $'000 $'000 $'000 Sales revenue 4,620 2,840 530 f Less cost of goods sold Opening inventories 680 630 i 30 Add purchases 3,600 2,120 f 530 Less closing inventories 710 440 20 8 Cost of goods sold 3.570 2.310 Gross profit 1,050 530 Dividend revenue 88 0 88 j Management fee revenue 35 0 35 d Interest revenue 0 9 9 Depreciation expense 160 125 1 10 Finance costs 181 35 9 Other expenses 204 49 35 c/d 35 Profit before tax 628 330 Tax expense 201 97 12 i/8/1 6 Profit after tax for the year 427 233 Retained earnings 1 July 2020 705 429 337 b/i/1 38 Dividends paid (57) (32) 32 Dividends declared (121) (56) j 56 Retained earnings 30 June 954 574 2021 Issued capital 800 350 350 b Revaluation surplus 210 0 Fair value adjustment 56 b/a 56 Shareholders' equity 1,964 924 Assets Cash 78 117 Accounts receivable 72 35 h 25 Dividends receivable 56 0 k 56 Inventories 710 440 8 20 Investment in Joey Ltd 750 0 b 750 Loan to Chandler Ltd 0 150 150 Land 720 250 80 Buildings 1,500 780 Accumulated depreciation (320) (494) Plant and equipment 850 450 1 Accumulated depreciation (235) (210) 30 1 85 Goodwill (net) 94 b/c 35 Deferred tax asset 24 8/1 9 Total assets 4,181 1,518 Less liabilities Current taxes payable 111 87 Accounts payable 292 50 25 h Dividend payable 121 56 56 k Loan from Joey Ltd 150 0 150 e Mortgage loan 1,253 401 Deferred tax liabilities 290 0 24 Net assets 1,964 924 1,956.00 1,956.00 800 210 ? 195 82 1,130 e a 1,050 2,280 (814) 1,325 (500) 25 59 15 4,822 198 317 121 1,654 314 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts