Question: Barrios Corporation reported pretax book income of $500,000. Tax depreciation exceeded book depreciation by $275,000. In addition, the company received $200,000 of tax-exempt life

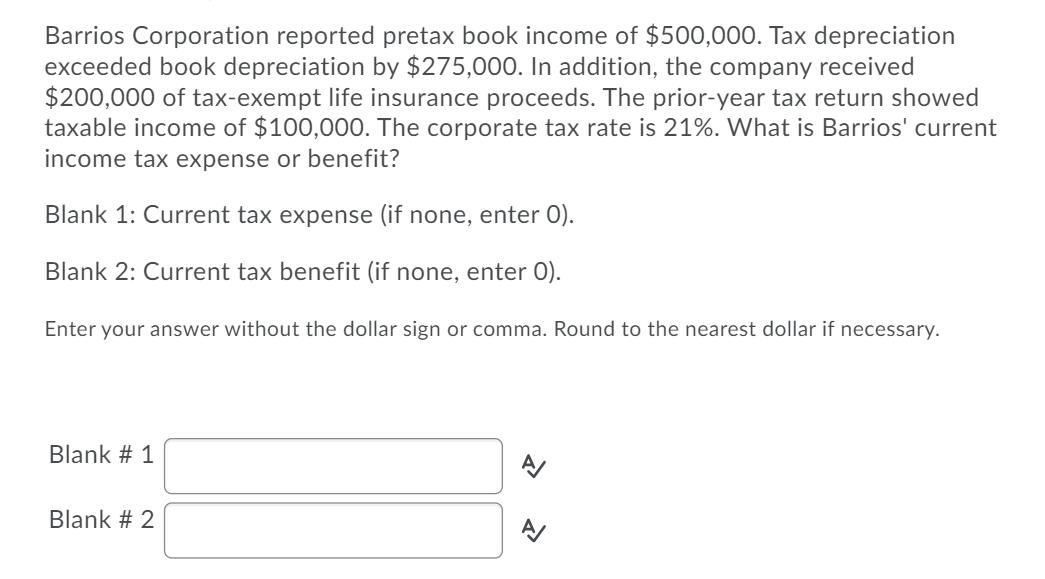

Barrios Corporation reported pretax book income of $500,000. Tax depreciation exceeded book depreciation by $275,000. In addition, the company received $200,000 of tax-exempt life insurance proceeds. The prior-year tax return showed taxable income of $100,000. The corporate tax rate is 21%. What is Barrios' current income tax expense or benefit? Blank 1: Current tax expense (if none, enter O). Blank 2: Current tax benefit (if none, enter O). Enter your answer without the dollar sign or comma. Round to the nearest dollar if necessary. Blank # 1 Blank # 2

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Solution Paeton book Income 500000 Less Excess tax depreciation 275000 Less ... View full answer

Get step-by-step solutions from verified subject matter experts