Question: Explain how each trader would set up a strategy to carry out their intended purpose. Be as specific as possible in each case, by providing

Explain how each trader would set up a strategy to carry out their intended purpose. Be as specific as possible in each case, by providing details about the strategy: the position (whether long or short), the size of the exposure (notional amount), the number of contracts involved (if more than one), the expiration date of the contracts, etc. In each case, explain whether the trader will realize a profit or a loss if the underlying asset/variable increases by 10%.

An institutional trader is tasked with seeking out arbitrage opportunities, and is particularly focused on price discrepancies between put and call options on Apple Inc. (Nasdaq: AAPL) stock. The institutional trader finds a European call option trading at $23.00, and a European put option trading at $5.00, when the stock price is $175.00. Both options have an exercise price of $160.00, and a maturity of six months. The risk-free interest rate is 2.0% (continuously compounded).

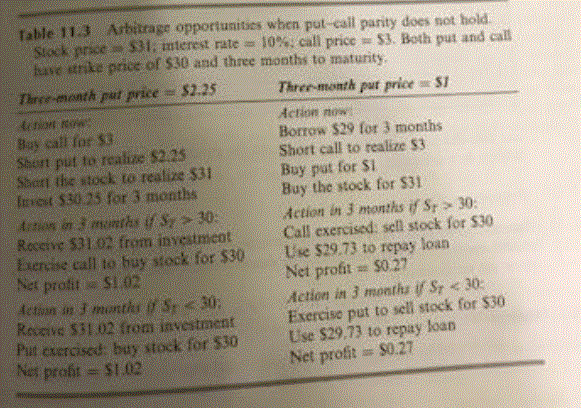

1. Does put-call parity hold? If not, then describe the arbitrage opportunity (see attachment table 11.3). 2. Will the institutional trader realize a profit or a loss if Apples stock price increases by 10% over the next six months?

Table 113 Arbitrage opportunities when put-cail parity does not hold Stock price o, 531; mterest rate-10%; call price $3. Both put and call thavo erike price of $30 and three months to maturity Three menth put price $2.25 Bay call for $3 Shert put to realiue $225 Soon the stock to realize 531 Imet $30.25 for 3 months Three-month put price ST Action now Borrow $29 for 3 months Short call to realize $3 Buy put for Si Buy the stock for $31 Action in 3 months if S30 Rocens 331 02 from inveatmentCall exercised sell stock for s30 Exercise call to buy stock for $30 Use $29.73 to repay loan Set profit e S102 Action ian I monthS, 30 Net profit $027 Action in 3 months if S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts