Question: Explain how fair value accounting may increase information risk. How does fair value accounting increase risk for a financial statement auditor? Explain how fair value

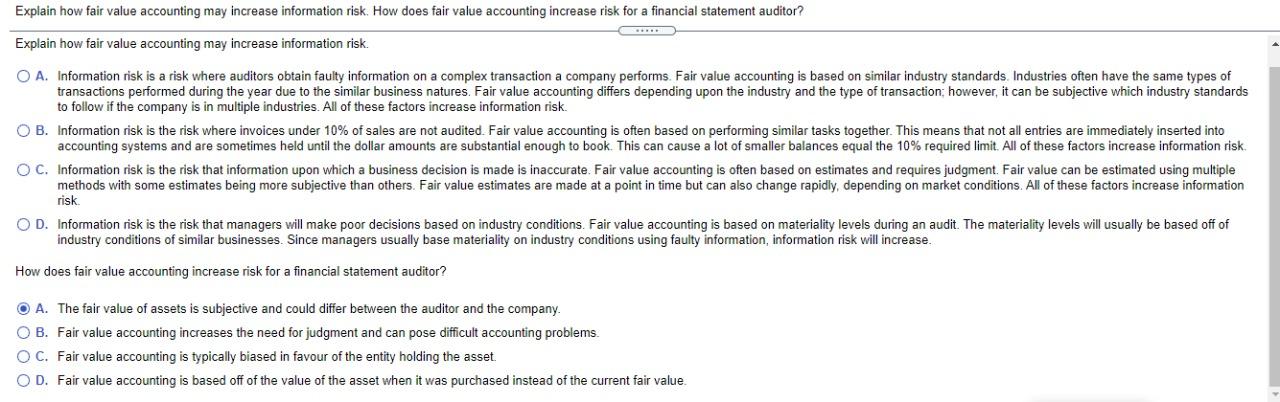

Explain how fair value accounting may increase information risk. How does fair value accounting increase risk for a financial statement auditor? Explain how fair value accounting may increase information risk. O A. Information risk is a risk where auditors obtain faulty information on a complex transaction a company performs. Fair value accounting is based on similar industry standards. Industries often have the same types of transactions performed during the year due to the similar business natures. Fair value accounting differs depending upon the industry and the type of transaction; however, it can be subjective which industry standards to follow if the company is in multiple industries. All of these factors increase information risk. O B. Information risk is the risk where invoices under 10% of sales are not audited. Fair value accounting is often based on performing similar tasks together. This means that not all entries are immediately inserted into accounting systems and are sometimes held until the dollar amounts are substantial enough to book. This can cause a lot of smaller balances equal the 10% required limit. All of these factors increase information risk. OC. Information risk is the risk that information upon which a business decision is made is inaccurate. Fair value accounting is often based on estimates and requires judgment. Fair value can be estimated using multiple methods with some estimates being more subjective than others. Fair value estimates are made at a point in time but can also change rapidly, depending on market conditions. All of these factors increase information risk OD. Information risk is the risk that managers will make poor decisions based on industry conditions. Fair value accounting is based on materiality levels during an audit. The materiality levels will usually be based off of industry conditions of similar businesses. Since managers usually base materiality on industry conditions using faulty information, information risk will increase. How does fair value accounting increase risk for a financial statement auditor? O A. The fair value of assets is subjective and could differ between the auditor and the company O B. Fair value accounting increases the need for judgment and can pose difficult accounting problems. O C. Fair value accounting is typically biased in favour of the entity holding the asset OD. Fair value accounting is based off of the value of the asset when it was purchased instead of the current fair value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts