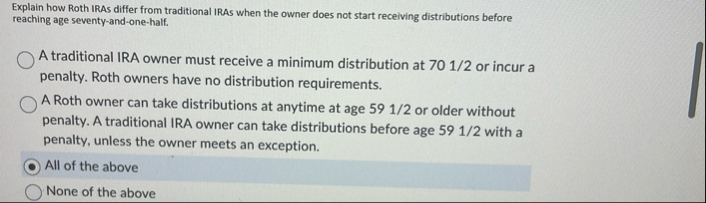

Question: Explain how Roth IRAs differ from traditional IRAs when the owner does not start receiving distributions before reaching age seventy - and - one -

Explain how Roth IRAs differ from traditional IRAs when the owner does not start receiving distributions before reaching age seventyandonehalf.

A traditional IRA owner must receive a minimum distribution at or incur a penalty. Roth owners have no distribution requirements.

A Roth owner can take distributions at anytime at age or older without penalty. A traditional IRA owner can take distributions before age with a penalty, unless the owner meets an exception.

All of the above

None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock