Question: EXPLAIN HOW THE ANSWER IS $1,250 AND SHOW WORK PLEASE!!!!!! It is now 2016. Mouse, Inc., a calendar year S corporation, is owped shareholders: Mickey,

EXPLAIN HOW THE ANSWER IS $1,250 AND SHOW WORK PLEASE!!!!!!

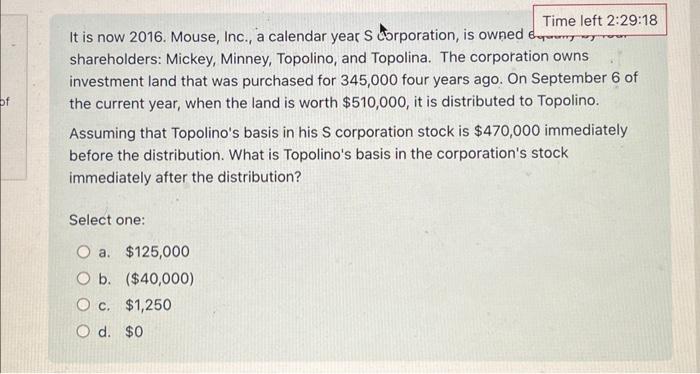

It is now 2016. Mouse, Inc., a calendar year S corporation, is owped shareholders: Mickey, Minney, Topolino, and Topolina. The corporation owns investment land that was purchased for 345,000 four years ago. On September 6 of the current year, when the land is worth $510,000, it is distributed to Topolino. Assuming that Topolino's basis in his S corporation stock is $470,000 immediately before the distribution. What is Topolino's basis in the corporation's stock immediately after the distribution? Select one: a. $125,000 b. ($40,000) c. $1,250 d. $0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock