Question: explain how they got theses answers and show work On January 1, 2018 DBT Company purchased a delivery truck from CRD Company for $100,000. DBT

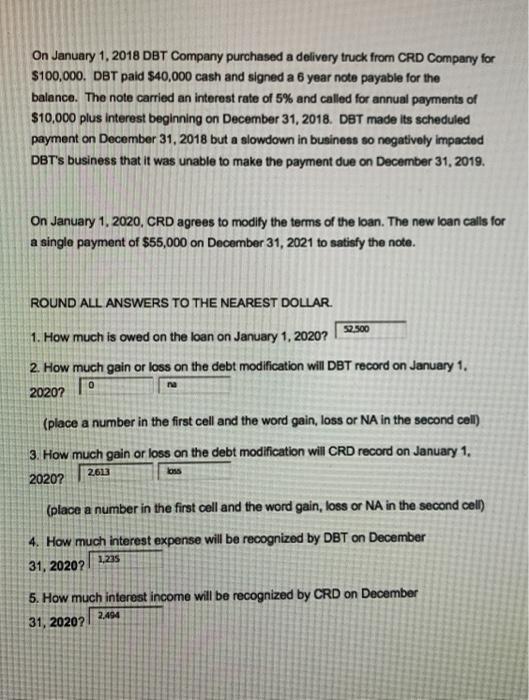

On January 1, 2018 DBT Company purchased a delivery truck from CRD Company for $100,000. DBT paid $40,000 cash and signed a 6 year note payable for the balance. The note carried an interest rate of 5% and called for annual payments of $10,000 plus interest beginning on December 31, 2018. DBT made its scheduled payment on December 31, 2018 but a slowdown in business so negatively impacted DBT's business that it was unable to make the payment due on December 31, 2019. On January 1, 2020, CRD agrees to modify the terms of the loan. The new loan calls for a single payment of $55,000 on December 31, 2021 to satisfy the note. ROUND ALL ANSWERS TO THE NEAREST DOLLAR. 2.500 1. How much is owed on the loan on January 1, 2020? 2. How much gain or loss on the debt modification will DBT record on January 1, 0 2020? (place a number in the first cell and the word gain, loss or NA in the second cell) 3. How much gain or loss on the debt modification will CRD record on January 1, 20202 2613 loss 1.235 (place a number in the first cell and the word gain, loss or NA in the second cell) 4. How much interest expense will be recognized by DBT on December 31, 2020? 5. How much interest income will be recognized by CRD on December 31, 2020? 2.494

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts