Question: Explain how to get to the last two boxes please! Whispering Inc. reports the following pretax income (loss) for both financial reporting purposes and tax

Explain how to get to the last two boxes please!

Explain how to get to the last two boxes please!

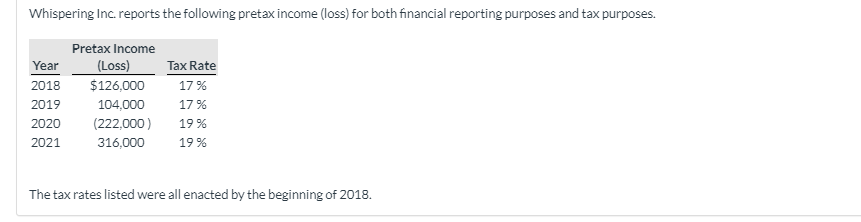

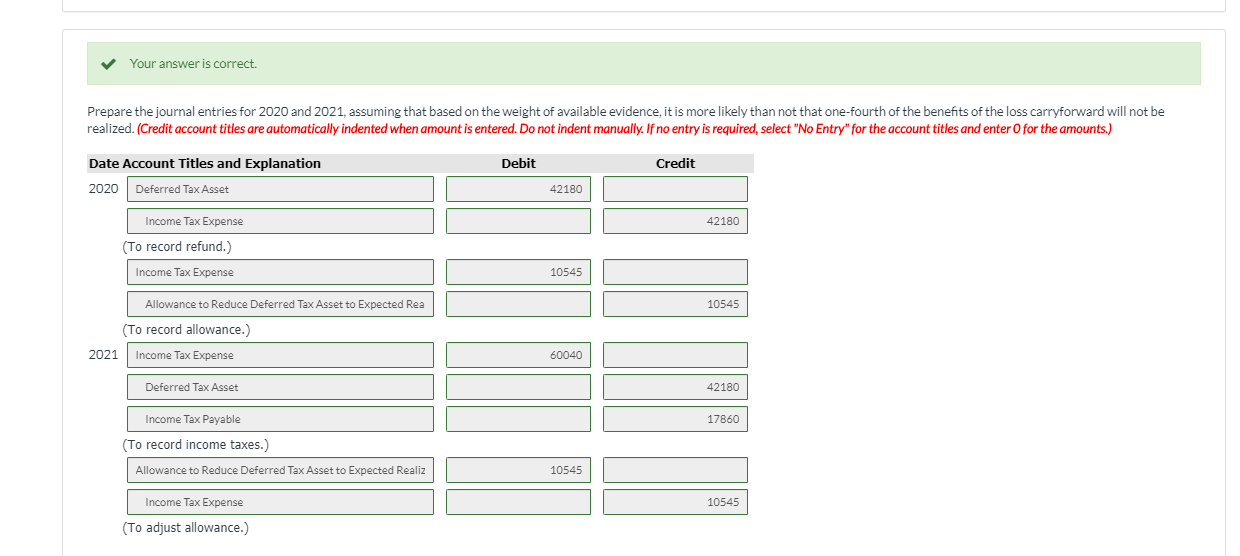

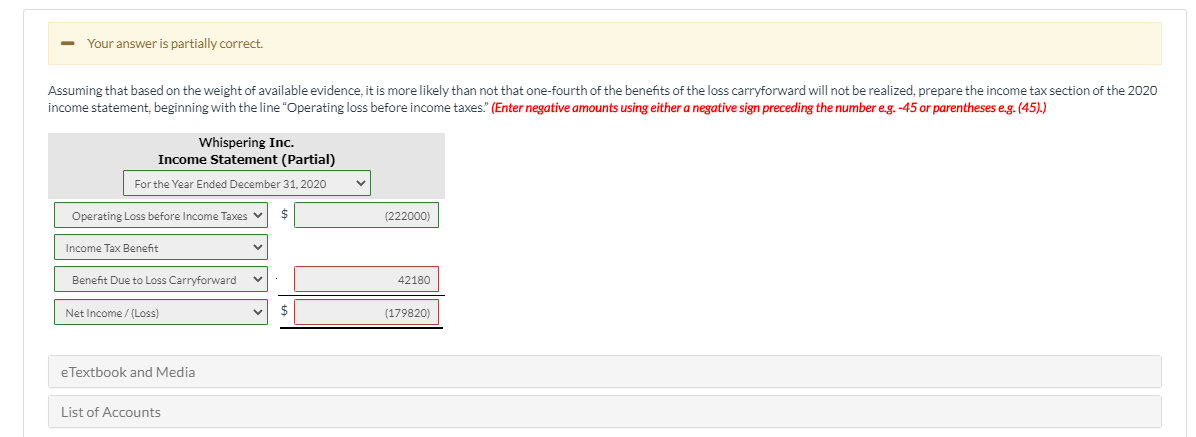

Whispering Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year 2018 2019 Pretax Income (Loss) $126,000 104.000 (222,000) 316,000 Tax Rate 17% 17 % 19 % 19 % 2020 2021 The tax rates listed were all enacted by the beginning of 2018. Your answer is correct. Prepare the journal entries for 2020 and 2021, assuming that based on the weight of available evidence, it is more likely than not that one-fourth of the benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation 2020 Deferred Tax Asset 42180 Income Tax Expense 42180 (To record refund.) Income Tax Expense 10545 10545 Allowance to Reduce Deferred Tax Asset to Expected Rea (To record allowance.) 2021 Income Tax Expense 60040 Deferred Tax Asset 42180 Income Tax Payable 17860 (To record income taxes.) Allowance to Reduce Deferred Tax Asset to Expected Realiz 10545 Income Tax Expense 10545 (To adjust allowance.) Your answer is partially correct. Assuming that based on the weight of available evidence, it is more likely than not that one-fourth of the benefits of the loss carryforward will not be realized, prepare the income tax section of the 2020 income statement, beginning with the line "Operating loss before income taxes." (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.g. (45).) Whispering Inc. Income Statement (Partial) For the Year Ended December 31, 2020 Operating Loss before Income Taxes $ (222000) Income Tax Benefit Benefit Due to Loss Carryforward 42180 Net Income / (Loss) $ (179820) e Textbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts