Question: Explain how to solve them and show work for each please 7. Assume that you are a consultant to Broske Inc, and you have been

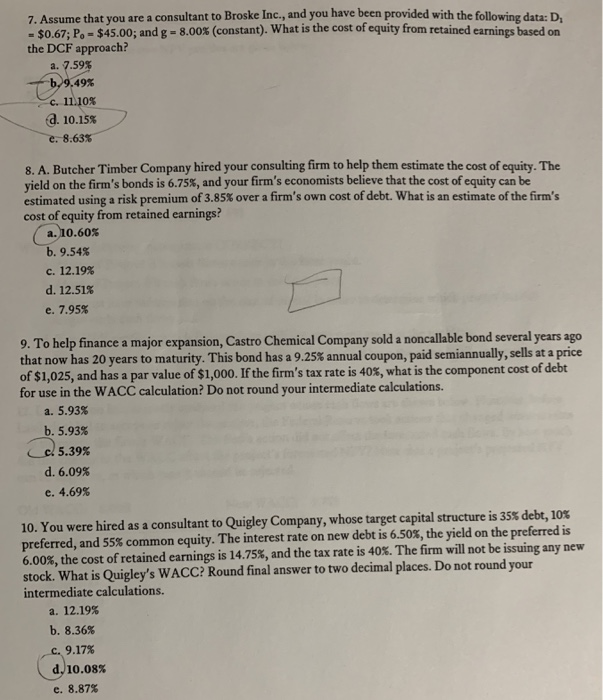

7. Assume that you are a consultant to Broske Inc, and you have been provided with the following data: D $0.67; P.-$45.00; and g-8.00% (constant) what is the cost of equity from retained earnings based on the DCF approach? a.. 7.59% by 9.49% 11.10% a. 10.15% e. 8.63% 8. A. Butcher Timber Company hired your consulting firm to help them estimate the cost of equity. The yield on the firm's bonds is 6.75%, and your firm's economists believe that the cost of equity can be estimated using a risk premium of 3.85% over a firm's own cost of debt. What is an estimate of the firm's cost of equity from retained earnings? a. 10.60% b. 9.54% . 12.19% d. 12.51% e. 7.95% 9. To help finance a major expansion, Castro Chemical Company sold a noncallable bond several years ago that now has 20 years to maturity. This bond has a 9.25% annual coupon, paid semiannually, sells at a price of $1,025, and has a par value of $1,000. If the firm's tax rate is 40%, what is the component cost of debt for use in the WACC calculation? Do not round your intermediate calculations. a. 5.93% b. 5.93% - 5.39% d. 6.09% e. 4.69% 10. You were hired as a consultant to Quigley Company, whose target capital structure is 35% debt, 10% preferred, and 55% common equity. The interest rate on new debt is 6.50%, the yield on the preferred is 6.00%, the cost of retained earnings is 14.75%, and the tax rate is 40%. The firm will not be issuing any new stock. What is Quigley's WACC? Round final answer to two decimal places. Do not round your intermediate calculations. a. 12.19% b. 8.36% 9.17% d) 10.08% e. 8.87%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts