Question: Explain, how would you account for the $2 million that New Balance spent in the R&D of Sneaker 2013? And why? Selling, general, and administrative

Explain, how would you account for the $2 million that New Balance spent in the R&D of Sneaker 2013? And why?

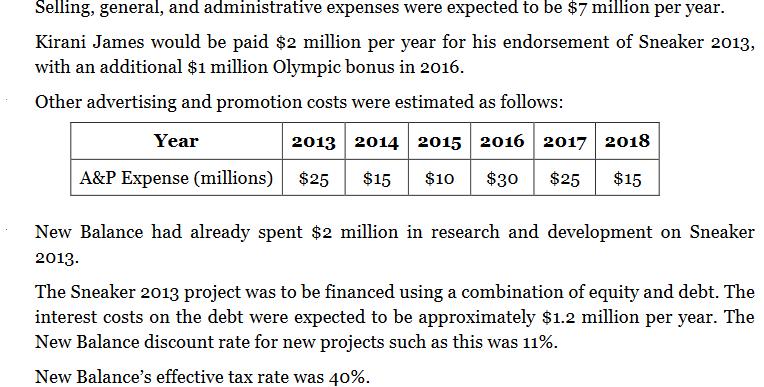

Selling, general, and administrative expenses were expected to be $7 million per year. Kirani James would be paid $2 million per year for his endorsement of Sneaker 2013, with an additional $1 million Olympic bonus in 2016. Other advertising and promotion costs were estimated as follows: Year 2013 2014 2015 2016 2017 2018 A&P Expense (millions) $25 $15 $10 $30 $25 $15 New Balance had already spent $2 million in research and development on Sneaker 2013. The Sneaker 2013 project was to be financed using a combination of equity and debt. The interest costs on the debt were expected to be approximately $1.2 million per year. The New Balance discount rate for new projects such as this was 11%. New Balance's effective tax rate was 40%.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

I would account for the 2 million that New Balance spent in the RD of Sneaker 2013 as a capitalized ... View full answer

Get step-by-step solutions from verified subject matter experts