Question: Explain how you got your answer and show work please. A construction company has three development alternatives; Option A would construct an oil and gas

Explain how you got your answer and show work please.

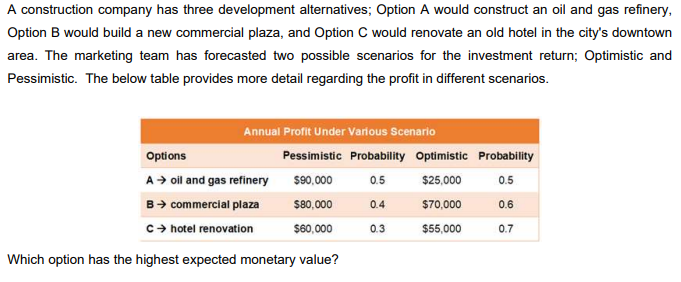

A construction company has three development alternatives; Option A would construct an oil and gas refinery, Option B would build a new commercial plaza, and Option C would renovate an old hotel in the city's downtown area. The marketing team has forecasted two possible scenarios for the investment return; Optimistic and Pessimistic. The below table provides more detail regarding the profit in different scenarios. Annual Profit Under Various Scenario Options Pessimistic Probability Optimistic Probability A oil and gas refinery $90,000 $25,000 0.5 B commercial plaza $80,000 $70,000 C + hotel renovation $60,000 0.3 $55,000 0.7 0.5 0.4 0.6 Which option has the highest expected monetary valueStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock