Question: explain in as much detail as possible and i do NOT want it in excel 1. Olivia recently purchased a new home and financed $275,000

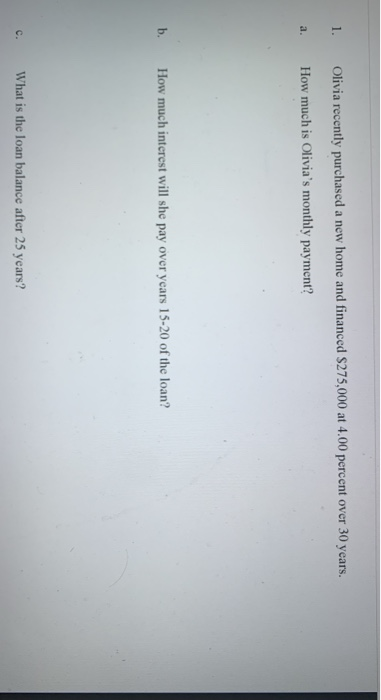

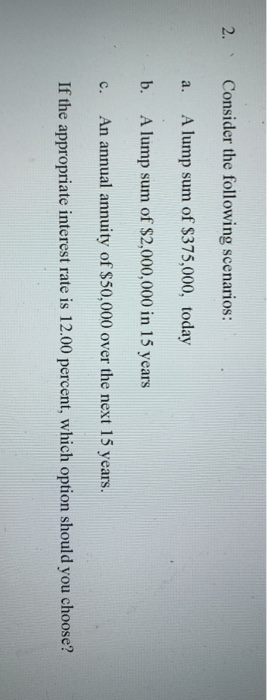

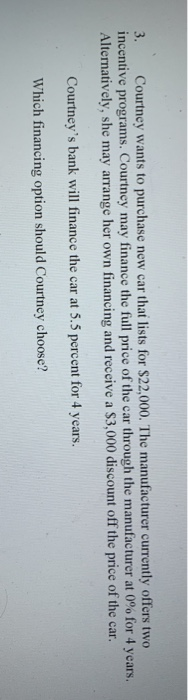

1. Olivia recently purchased a new home and financed $275,000 at 4.00 percent over 30 years. a How much is Olivia's monthly payment? b. How much interest will she pay over years 15-20 of the loan? c. What is the loan balance after 25 years? d. What is the effective rate on the loan? 2. Consider the following scenarios: a. A lump sum of $375,000, today b. A lump sum of $2,000,000 in 15 years c. An annual annuity of $50,000 over the next 15 years. If the appropriate interest rate is 12.00 percent, which option should you choose? 3. Courtney wants to purchase new car that lists for $22,000. The manufacturer currently offers two incentive programs. Courtney may finance the full price of the car through the manufacturer at 0% for 4 years. Alternatively, she may arrange her own financing and receive a $3,000 discount off the price of the car. Courtney's bank will finance the car at 5.5 percent for 4 years. Which financing option should Courtney choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts