Question: Explain in detail by excel, please. 1 Problem Case One (35 points) 2 3 As of October 2021, we observe the quotes from the open

Explain in detail by excel, please.

Explain in detail by excel, please.

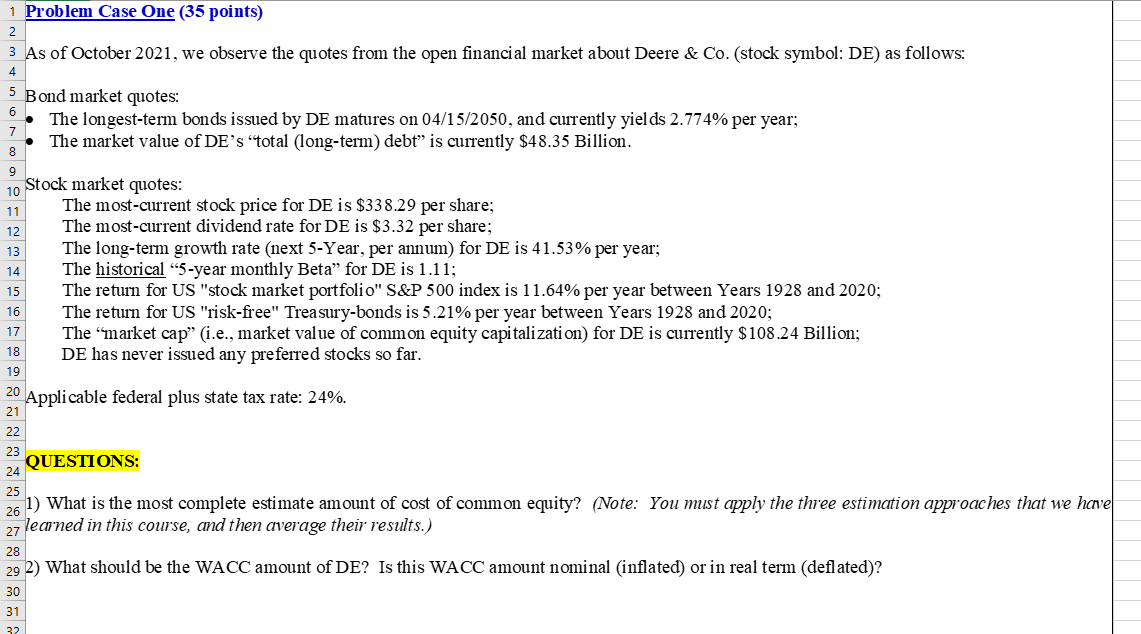

1 Problem Case One (35 points) 2 3 As of October 2021, we observe the quotes from the open financial market about Deere & Co. (stock symbol: DE) as follows: 4 7 8 11 5 Bond market quotes: 6 The longest-term bonds issued by DE matures on 04/15/2050, and currently yields 2.774% per year; The market value of DE's "total (long-term) debt" is currently $48.35 Billion. 9 Stock market quotes: 10 The most-current stock price for DE is $338.29 per share; 12 The most current dividend rate for DE is $3.32 per share; The long-term growth rate (next 5-Year, per annum) for DE is 41.53% per year; The historical "5-year monthly Beta for DE is 1.11; The return for US "stock market portfolio" S&P 500 index is 11.64% per year between Years 1928 and 2020; The return for US "risk-free" Treasury-bonds is 5.21% per year between Years 1928 and 2020; 17 The market cap" (i.e., market value of common equity capitalization) for DE is currently $108.24 Billion; 18 DE has never issued any preferred stocks so far. 19 20 Applicable federal plus state tax rate: 24%. 21 22 23 QUESTIONS: 24 13 14 15 16 25 26 1) What is the most complete estimate amount of cost of common equity? (Note: You must apply the three estimation approaches that we have 27 learned in this course, and then average their results.) 28 29 2) What should be the WACC amount of DE? Is this WACC amount nominal (inflated) or in real term (deflated)? 30 31 32 1 Problem Case One (35 points) 2 3 As of October 2021, we observe the quotes from the open financial market about Deere & Co. (stock symbol: DE) as follows: 4 7 8 11 5 Bond market quotes: 6 The longest-term bonds issued by DE matures on 04/15/2050, and currently yields 2.774% per year; The market value of DE's "total (long-term) debt" is currently $48.35 Billion. 9 Stock market quotes: 10 The most-current stock price for DE is $338.29 per share; 12 The most current dividend rate for DE is $3.32 per share; The long-term growth rate (next 5-Year, per annum) for DE is 41.53% per year; The historical "5-year monthly Beta for DE is 1.11; The return for US "stock market portfolio" S&P 500 index is 11.64% per year between Years 1928 and 2020; The return for US "risk-free" Treasury-bonds is 5.21% per year between Years 1928 and 2020; 17 The market cap" (i.e., market value of common equity capitalization) for DE is currently $108.24 Billion; 18 DE has never issued any preferred stocks so far. 19 20 Applicable federal plus state tax rate: 24%. 21 22 23 QUESTIONS: 24 13 14 15 16 25 26 1) What is the most complete estimate amount of cost of common equity? (Note: You must apply the three estimation approaches that we have 27 learned in this course, and then average their results.) 28 29 2) What should be the WACC amount of DE? Is this WACC amount nominal (inflated) or in real term (deflated)? 30 31 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts