Question: explain in detail please, thank you :) Consider only three assets, GM stock, Toyota stock, (risk-free) Japanese national bond in a market: The total market

explain in detail please, thank you :)

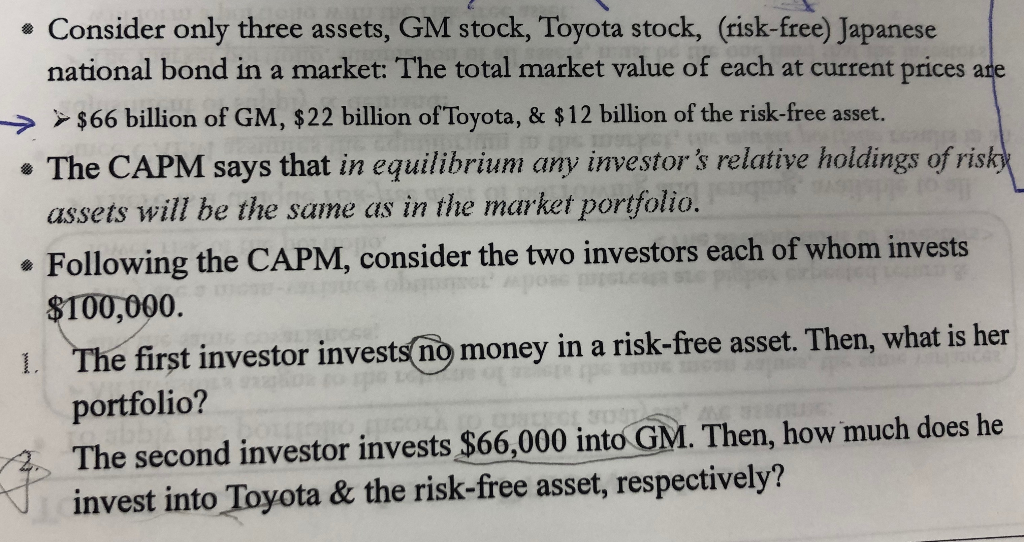

Consider only three assets, GM stock, Toyota stock, (risk-free) Japanese national bond in a market: The total market value of each at current prices are > >$66 billion of GM, $22 billion of Toyota, & $12 billion of the risk-free asset. The CAPM says that in equilibrium any investor's relative holdings of risk assets will be the same as in the market portfolio. Following the CAPM, consider the two investors each of whom invests $100,000 1. The first investor invests no money in a risk-free asset. Then, what is her portfolio? A. The second investor invests $66,000 into GM. Then, how much does he v invest into Toyota & the risk-free asset, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts