Question: explain it When evaluating a project, a firm's managers should select projects whose cash flows 79. O A. have the lowest NPVs after discounting cash

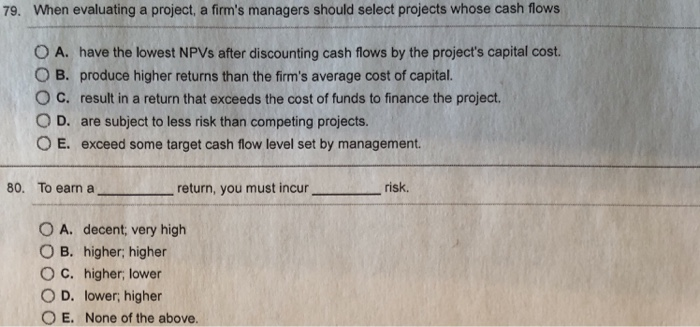

When evaluating a project, a firm's managers should select projects whose cash flows 79. O A. have the lowest NPVs after discounting cash flows by the project's capital cost. O B. produce higher returns than the firm's average cost of capital. O C. result in a return that exceeds the cost of funds to finance the project. O D. are subject to less risk than competing projects. O E. exceed some target cash flow level set by management. 80. To earn a return, you must incur risk. - O A. decent; very high O B. higher; higher O C. higher, lower O D. lower, higher OE. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts