Question: explain marte hare wanted Commen stock value Variable growth Lawrence in most recent was there, precind to growly for years towed by a colorare in

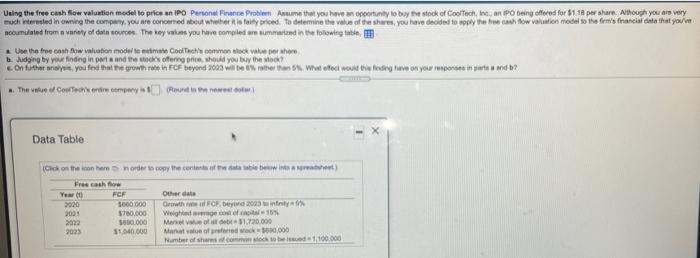

marte hare wanted Commen stock value Variable growth Lawrence in most recent was there, precind to growly for years towed by a colorare in years to try The market value of www.cers whore Round to the normal cent) Common stock value Variable growth Lawrence Industries' most recent annual dividend was $1,50 per share (D - $1.59), and the firm's required retum is 14%. Find the market value of Lawrence's shares when dividends are expected to grow at 16% annually for 3 years, followed by a 5% constant annual growth rate in years to infinity The market value of Lawrence's shares is $). (Round to the nearest cent) Using the free cash flow valuation model to price an IPO Personal Finance Problem Ansume that you have an opportunity to buy the stock of CoolTech, Inc., or iPo being offered for 11 per share. Although you are very much terested in owning the company you are concerned about whether it is foly priced to determine the value of the shorts, you have decided to be for show alation model to the firm's financial data that you/ mecumdiated from a variety of data source. The key as you have compiled a summarted in the following the Use the free cash flow valuation model tema Cool Tuctie common locale per doing by you finding in part in the offering price should you buy them? con tuttar nyes, you fedha te sprowth rate on For beyond 2023 write meber than what efect would thin fosing how on you mpenses in parte db? The Cool Tech's entire company Round in the newest of Data Table Click on the chance to copy the corner Free cash flow Year FCF Other date 2020 5000.000 Growth of FCF Beyin 2003 infrin 2025 $700.000 Weighing 15% 2022 500.000 Marof 31,720.000 2023 S40.000 Manfredo,000 Number of shoot bed 1,100.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts