Question: explain part 2 please ? Intro A corporate bond pays interest twice a year and has 18 years to maturity, a face value of $1,000

explain part 2 please ?

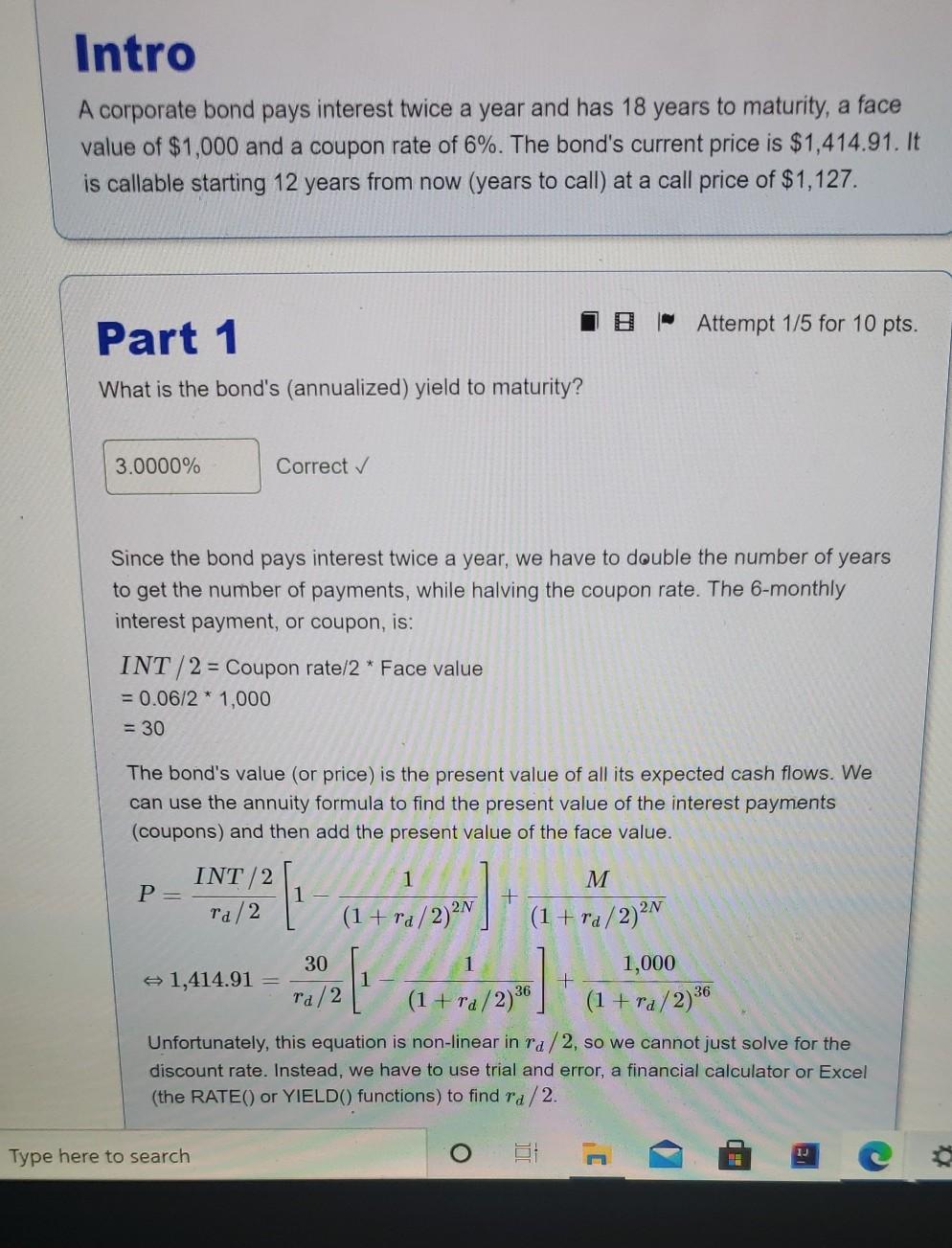

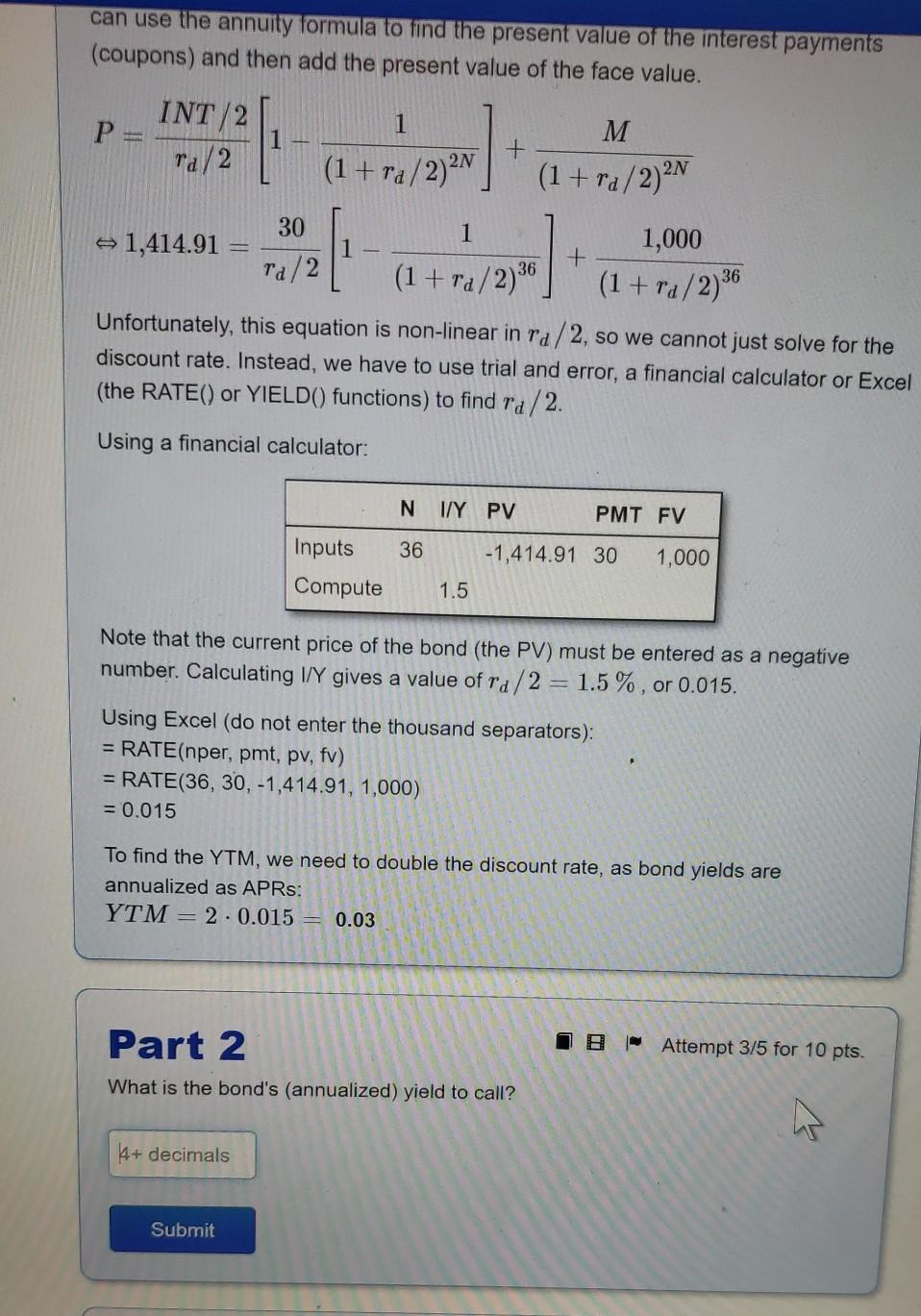

Intro A corporate bond pays interest twice a year and has 18 years to maturity, a face value of $1,000 and a coupon rate of 6%. The bond's current price is $1,414.91. It is callable starting 12 years from now (years to call) at a call price of $1,127. Part 1 - Attempt 1/5 for 10 pts. What is the bond's (annualized) yield to maturity? 3.0000% Correct Since the bond pays interest twice a year, we have to double the number of years to get the number of payments, while halving the coupon rate. The 6-monthly interest payment, or coupon, is: INT/2 = Coupon rate/2* Face value = 0.06/2* 1,000 = 30 The bond's value (or price) is the present value of all its expected cash flows. We can use the annuity formula to find the present value of the interest payments (coupons) and then add the present value of the face value. INT/2 P= 1 M [ + ra/2 (1+ra/2)2N (1+ra/2)2N 1 1,414.91 30 ra/2 1 1,000 + (1+T4/ 2030 36 (1+T4/2) Unfortunately, this equation is non-linear in ra/2, so we cannot just solve for the discount rate. Instead, we have to use trial and error, a financial calculator or Excel (the RATE() or YIELD() functions) to find ra/2. Type here to search O 12 can use the annuity formula to find the present value of the interest payments (coupons) and then add the present value of the face value. INT/2 1 - ra/2 2N (1+T4/2) M + (1+ra/2)2N f 30 1 1,414.91 1,000 + 2 (1+T4/2236 (1+T4/2136 Unfortunately, this equation is non-linear in ra/2, so we cannot just solve for the discount rate. Instead, we have to use trial and error, a financial calculator or Excel (the RATE() or YIELD() functions) to find ra/2. Using a financial calculator: N1/Y PV PMT FV 36 -1,414.91 30 Inputs Compute 1,000 1.5 Note that the current price of the bond (the PV) must be entered as a negative number. Calculating I/ gives a value of ra/2 = 1.5%, or 0.015. Using Excel (do not enter the thousand separators): = RATE(nper, pmt, pv, fv) = RATE(36, 30,-1,414.91, 1,000) = 0.015 To find the YTM, we need to double the discount rate, as bond yields are annualized as APRs: YTM = 2 -0.015 = 0.03 18 Attempt 3/5 for 10 pts. Part 2 What is the bond's (annualized) yield to call? A 4+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts