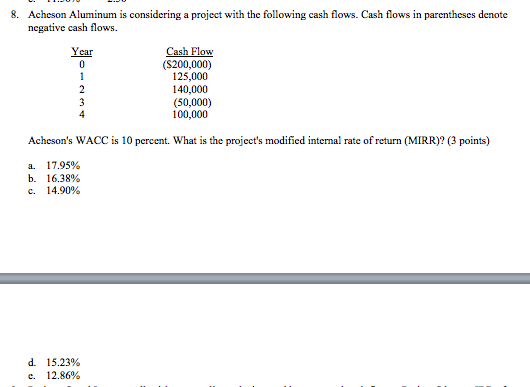

Question: explain please. 8. Acheson Aluminum is considering a project with the following cash flows. Cash flows in parentheses denote negative cash flows Cash Flow (S200,000)

explain please.

explain please.

8. Acheson Aluminum is considering a project with the following cash flows. Cash flows in parentheses denote negative cash flows Cash Flow (S200,000) 125,000 140,000 (50,000) 100,000 Acheson's WACC is 10 percent. What is the project's modified internal rate of return (MIRR)? (3 points) a. b. c. 17.95% 16.38% 14.90% 15.23% 12.86% d. c

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock