Question: Explain Please, will give you thumbs up. You and your spouse are in good health and have reasonably secure careers. You make about $75,500 annually

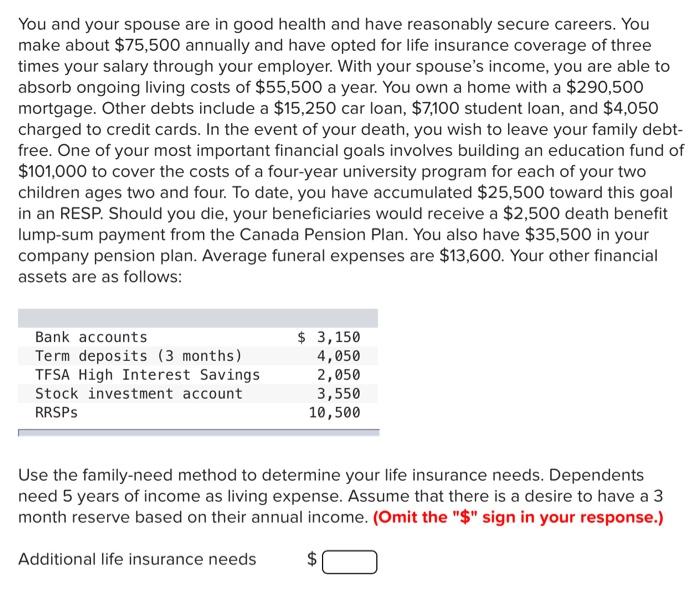

You and your spouse are in good health and have reasonably secure careers. You make about $75,500 annually and have opted for life insurance coverage of three times your salary through your employer. With your spouse's income, you are able to absorb ongoing living costs of $55,500 a year. You own a home with a $290,500 mortgage. Other debts include a $15,250 car loan, $7,100 student loan, and $4,050 charged to credit cards. In the event of your death, you wish to leave your family debtfree. One of your most important financial goals involves building an education fund of $101,000 to cover the costs of a four-year university program for each of your two children ages two and four. To date, you have accumulated $25,500 toward this goal in an RESP. Should you die, your beneficiaries would receive a $2,500 death benefit lump-sum payment from the Canada Pension Plan. You also have $35,500 in your company pension plan. Average funeral expenses are $13,600. Your other financial assets are as follows: Use the family-need method to determine your life insurance needs. Dependents need 5 years of income as living expense. Assume that there is a desire to have a 3 month reserve based on their annual income. (Omit the "\$" sign in your response.) Additional life insurance needs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts