Question: Explain Plz Required information Exercise 11-3 (Static) Depreciation methods; partial periods [LO11-2] [The following information applies to the questions displayed below] On October 1, 2021,

![Explain Plz Required information Exercise 11-3 (Static) Depreciation methods; partial periods [LO11-2]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f79eaedf3eb_04666f79eae68674.jpg)

![[The following information applies to the questions displayed below] On October 1,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f79eaf7b63d_04766f79eaf1fd19.jpg)

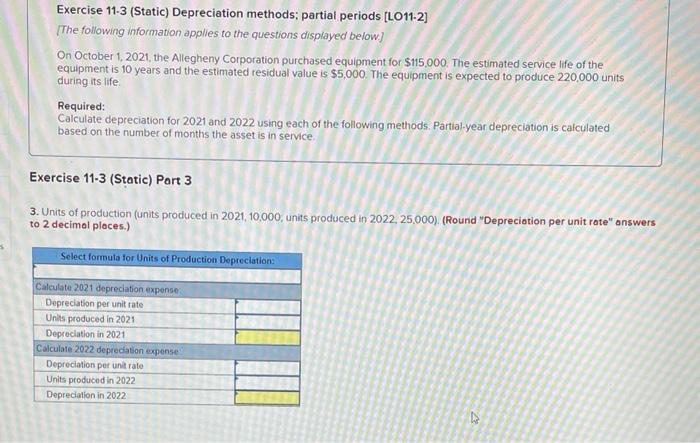

Required information Exercise 11-3 (Static) Depreciation methods; partial periods [LO11-2] [The following information applies to the questions displayed below] On October 1, 2021, the Allegheny Corporation purchased equipment for $115,000. The estimated service life of the equipment is 10 years and the estimated residual value is $5,000. The equipment is expected to produce 220,000 units during its life. Required: Calculate depreciation for 2021 and 2022 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. Exercise 11-3 (Static) Part 1 1. Straight-line. Formula Amounts Year 2021 2022 Choose Numerator: Beginning Book Value Annual Depreciation Straight-Line Depreciation Choose Denominator: Estimated Units of Production Fraction of Year Annual Depreciation Annual Depreciation Depreciation expense Exercise 11-3 (Static) Depreciation methods; partial periods [LO11-2] [The following information applies to the questions displayed below] On October 1, 2021, the Allegheny Corporation purchased equipment for $115,000. The estimated service life of the equipment is 10 years and the estimated residual value is $5,000. The equipment is expected to produce 220,000 units during its life. Required: Calculate depreciation for 2021 and 2022 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. Exercise 11-3 (Static) Part 2 2. Double-declining-balance. Formula Amount for 2021 Amount for 2022 Choose Numerator: Double Declining Balance Method x Choose Denominator: ** % x % Fraction of Year Fraction of Year Depreciation Expense Depreciation Expense Exercise 11-3 (Static) Depreciation methods; partial periods [LO11-2] [The following information applies to the questions displayed below] On October 1, 2021, the Allegheny Corporation purchased equipment for $115,000. The estimated service life of the equipment is 10 years and the estimated residual value is $5,000. The equipment is expected to produce 220,000 units during its life. Required: Calculate depreciation for 2021 and 2022 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. Exercise 11-3 (Static) Part 3 3. Units of production (units produced in 2021, 10,000, units produced in 2022, 25,000). (Round "Depreciation per unit rate" answers to 2 decimal places.) Select formula for Units of Production Depreciation: Calculate 2021 depreciation expense Depreciation per unit rate Units produced in 2021 Depreciation in 2021 Calculate 2022 depreciation expense Depreciation per unit rate Units produced in 2022 Depreciation in 2022 D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts