Question: explain question 6, 7 and 9 with steps please. 6. On January 1, Northern Fried Chicken Corporation issues $10,000,000 of 5-year, 10% bonds when the

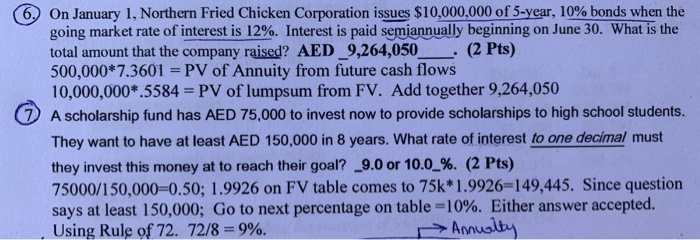

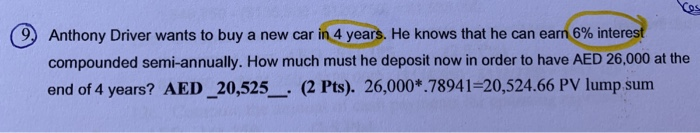

6. On January 1, Northern Fried Chicken Corporation issues $10,000,000 of 5-year, 10% bonds when the going market rate of interest is 12%. Interest is paid semiannually beginning on June 30. What is the total amount that the company raised? AED_9,264,050 (2 Pts) 500,000*7.3601 = PV of Annuity from future cash flows 10,000,000*.5584 = PV of lumpsum from FV. Add together 9,264,050 7 A scholarship fund has AED 75,000 to invest now to provide scholarships to high school students. They want to have at least AED 150,000 in 8 years. What rate of interest to one decimal must they invest this money at to reach their goal? _9.0 or 10.0_%. (2 Pts) 75000/150,000=0.50; 1.9926 on FV table comes to 75k* 1.9926=149,445. Since question says at least 150,000; Go to next percentage on table=10%. Either answer accepted. Using Rule of 72. 72/8 = 9%. Annuilty 9 Anthony Driver wants to buy a new car in 4 years. He knows that he can earn 6% interest compounded semi-annually. How much must he deposit now in order to have AED 26,000 at the end of 4 years? AED _20,525_ (2 Pts). 26,000*.78941=20,524.66 PV lump sum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts