Question: Explain solution please. Consider the following table and assume that CAPM holds. If we were to construct an arbitrage portfolio, what would be the weights

Explain solution please.

Explain solution please.

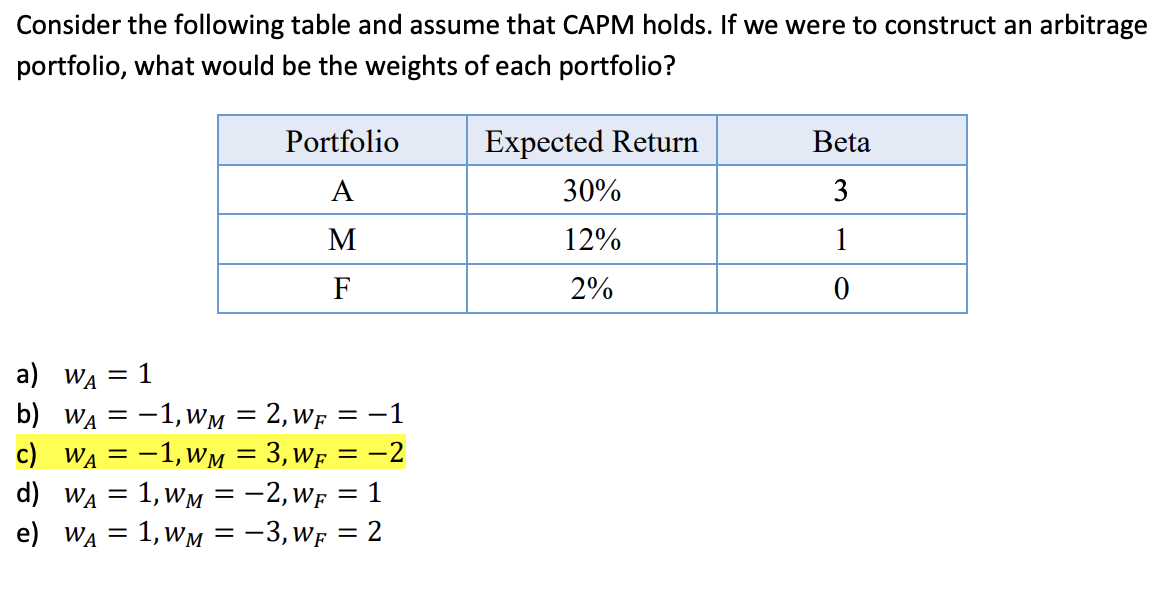

Consider the following table and assume that CAPM holds. If we were to construct an arbitrage portfolio, what would be the weights of each portfolio? Portfolio A M F Expected Return 30% 12% 2% Beta 3 1 0 a) wa = 1 b) wa = -1,wm = 2, we = -1 c) WA = -1, wm = 3,we = -2 d) wa = 1, wm = -2,wp = 1 e) wa = 1, wm = -3, wf = 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts