Question: explain. step by step in excel Binomial short-term interest-rate model with the true probability measure a. We observe the following spot rate curve. Assume semiannual

explain. step by step in excel

explain. step by step in excel

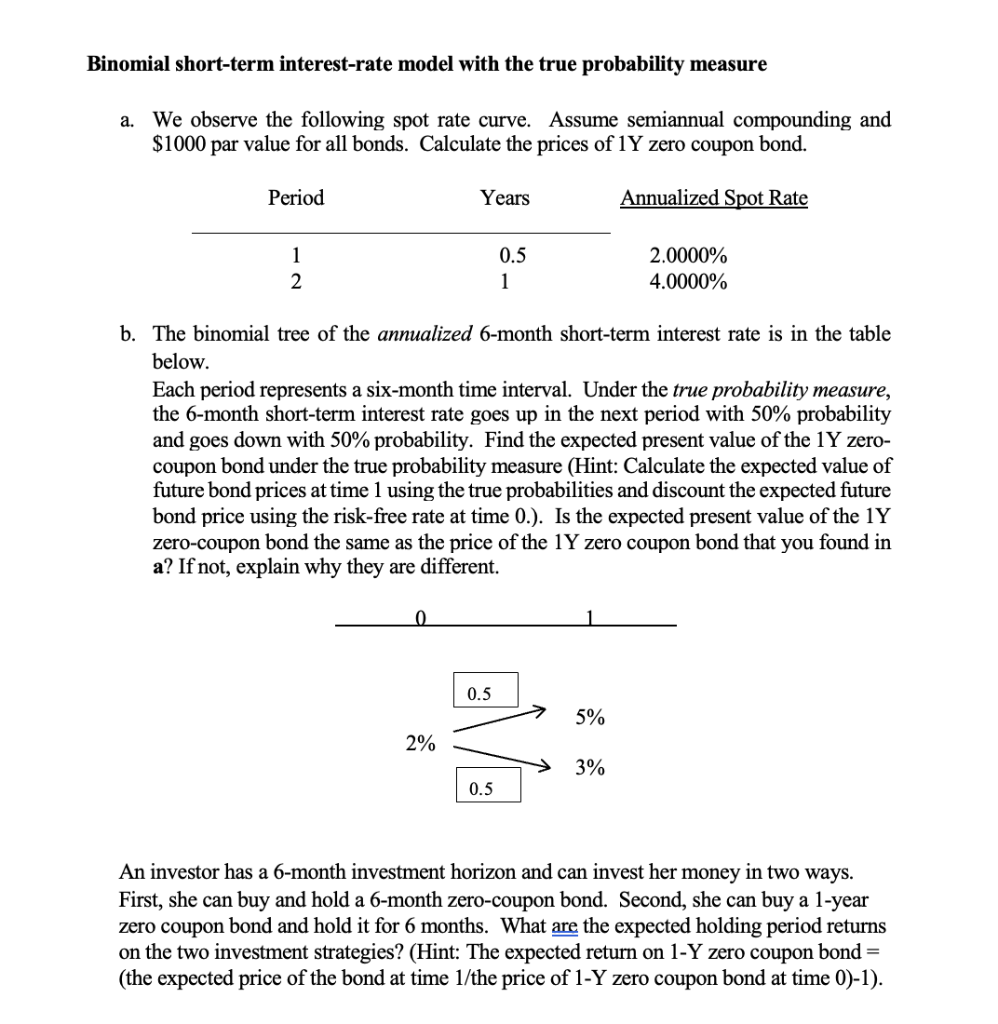

Binomial short-term interest-rate model with the true probability measure a. We observe the following spot rate curve. Assume semiannual compounding and $1000 par value for all bonds. Calculate the prices of 1Y zero coupon bond. Period Years Annualized Spot Rate 1 2 0.5 1 2.0000% 4.0000% b. The binomial tree of the annualized 6-month short-term interest rate is in the table below. Each period represents a six-month time interval. Under the true probability measure, the 6-month short-term interest rate goes up in the next period with 50% probability and goes down with 50% probability. Find the expected present value of the 1Y zero- coupon bond under the true probability measure (Hint: Calculate the expected value of future bond prices at time 1 using the true probabilities and discount the expected future bond price using the risk-free rate at time 0.). Is the expected present value of the 1Y zero-coupon bond the same as the price of the 1Y zero coupon bond that you found in a? If not, explain why they are different. 0 0.5 5% 2% 3% 0.5 An investor has a 6-month investment horizon and can invest her money in two ways. First, she can buy and hold a 6-month zero-coupon bond. Second, she can buy a 1-year zero coupon bond and hold it for 6 months. What are the expected holding period returns on the two investment strategies? (Hint: The expected return on 1-Y zero coupon bond = (the expected price of the bond at time 1/the price of 1-Y zero coupon bond at time 0)-1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts