Question: Explain Stock-based compensation expense (In millions) 2020 2019 $ $ June 30, Deferred Income Tax Assets Stock-based compensation expense Accruals, reserves, and other expenses Loss

Explain Stock-based compensation expense

Explain Stock-based compensation expense

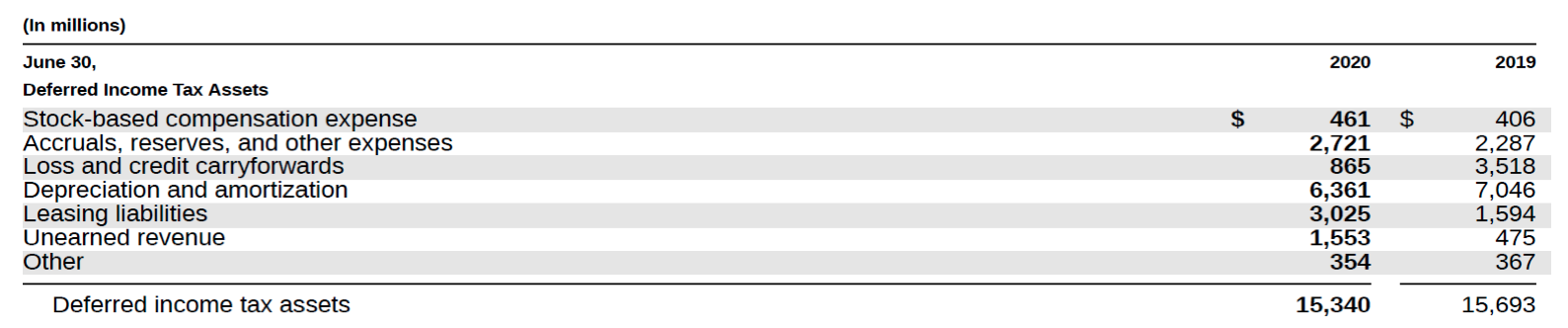

(In millions) 2020 2019 $ $ June 30, Deferred Income Tax Assets Stock-based compensation expense Accruals, reserves, and other expenses Loss and credit carryforwards Depreciation and amortization Leasing liabilities Unearned revenue Other 461 2,721 865 6,361 3,025 1,553 354 406 2,287 3,518 7,046 1,594 475 367 Deferred income tax assets 15,340 15,693

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock