Question: Explain the amounts that were excluded from the moving expense deductions. ( Select all that apply. ) A . Expenses relating to house - hunting

Explain the amounts that were excluded from the moving expense deductions. Select all that apply.

A Expenses relating to househunting trips prior to the move do not qualify as moving expenses.

B The costs with the hotel when MegMeg travelled from Montreal to Vancouver are not included because costs for lodging during a move are limited to a maximum of days. The daily costs in Montreal and Vancouver greater than the daily cost during the trip.

C The simplified mileage rate is not included because MegMeg is keeping detailed receipts when calculating her moving expenses.

D The costs with the hotel in Vancouver are not included because costs for food and lodging at or near an old or new residence are limited to a maximum of days. The daily cost in Montreal is greater than the daily cost in Vancouver.

E Gas is not included because MegMeg is using the simplified method of determining vehicle and food costs in calculating her moving expenses.

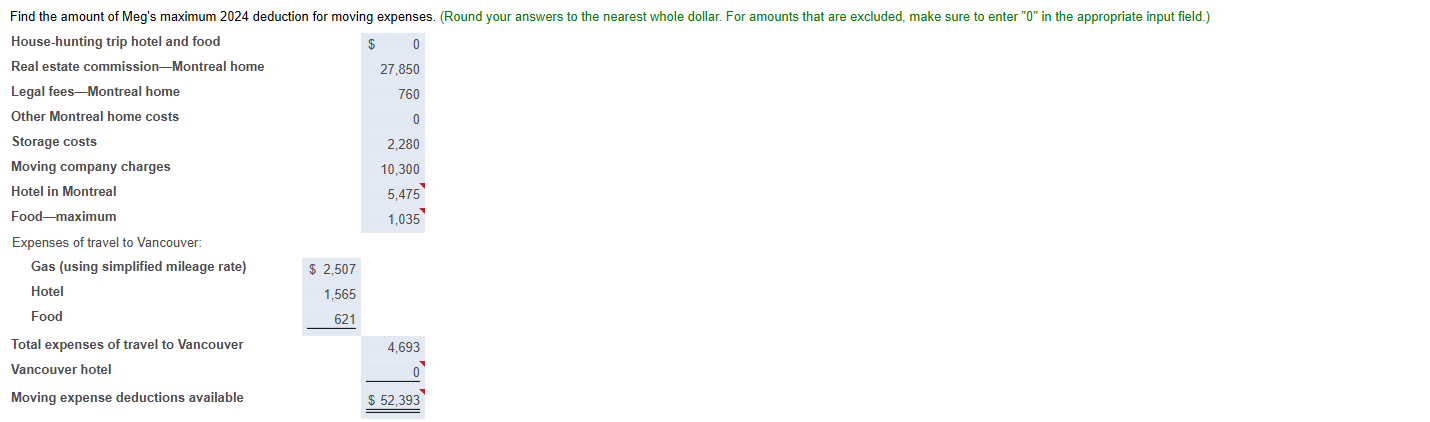

F Expenses related to cleaning and minor repairs are not included because they do not qualify as moving expenses. Find the amount of Meg's maximum deduction for moving expenses. Round your answers to the nearest whole dollar. For amounts that are excluded, make sure to enter in the appropriate input field. Find the amount of Meg's maximum deduction for moving expenses. Round your answers to the nearest whole dollar. For amounts that are excluded, make sure to enter in the appropriate input field.

In September Meg flies to Vancouver to locate a new residence. While she is there, she is unable to locate a property at a price she can afford. After her return to Montreal, she searches online and finally manages to lease a suitable condominium in Vancouver for $ a month. The lease is for months beginning December The costs associated with this househunting trip follow. Sale of Residence

At the beginning of September Meg lists her Montreal residence for sale. She had paid $ for the residence several years ago but was only able to sell it for $ Costs associated with this sale follow.

Real estate commissions

$

Legal fees

Unpaid property taxes to the date of the sale

Cost of cleaning and minor repairs prior to the sale

While Meg will continue to work in Montreal until November the closing date on the sale of the Montreal house is October Because of this, all her furnishings must be put into storage until they are shipped on November The storage costs are $ In addition, the moving company charges $ for the costs of the move, including packing in Montreal and unpacking at the condominium in Vancouver.

During the period October up to and including November Meg stays in a hotel in Montreal.

On November she departs for Vancouver. She drives her own vehicle, arriving in Vancouver on November She puts kilometres on her vehicle in making the trip.

As the condominium unit is not available until December she spends seven nights in a Vancouver hotel.

Her expenses for the period October up to and including December follow.

Meg will use the simplified method of determining vehicle and food costs in calculating her moving expenses as she is not interested in keeping detailed receipts. Assume that the relevant mileage rate for vehicle expenses is $ for Quebec and $ for British Columbia, and the flat rate for meals is $ per day. Employer assistance

To assist her with the move, the Vancouver office personnel will do the following:

They will provide her with a $ allowance to cover her general moving expenses.

They will compensate her, in full, for any loss on the sale of her Montreal residence. The loss will be determined without consideration of any selling costs.

They will provide a onetime payment of $ to assist her in dealing with the higher housing costs in Vancouver.

Meg begins working in Vancouver on December She will claim the maximum moving expense deduction for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock