Question: Explain the changes to Apple's 2008 and 2009 balance sheets and its 2007, 2008, and 2009 income statements ( Exhibit 3). Do the restated financial

Explain the changes to Apple's 2008 and 2009 balance sheets and its 2007, 2008, and 2009 income statements ( Exhibit 3). Do the restated financial statements better reflect Apple's financial conditions?

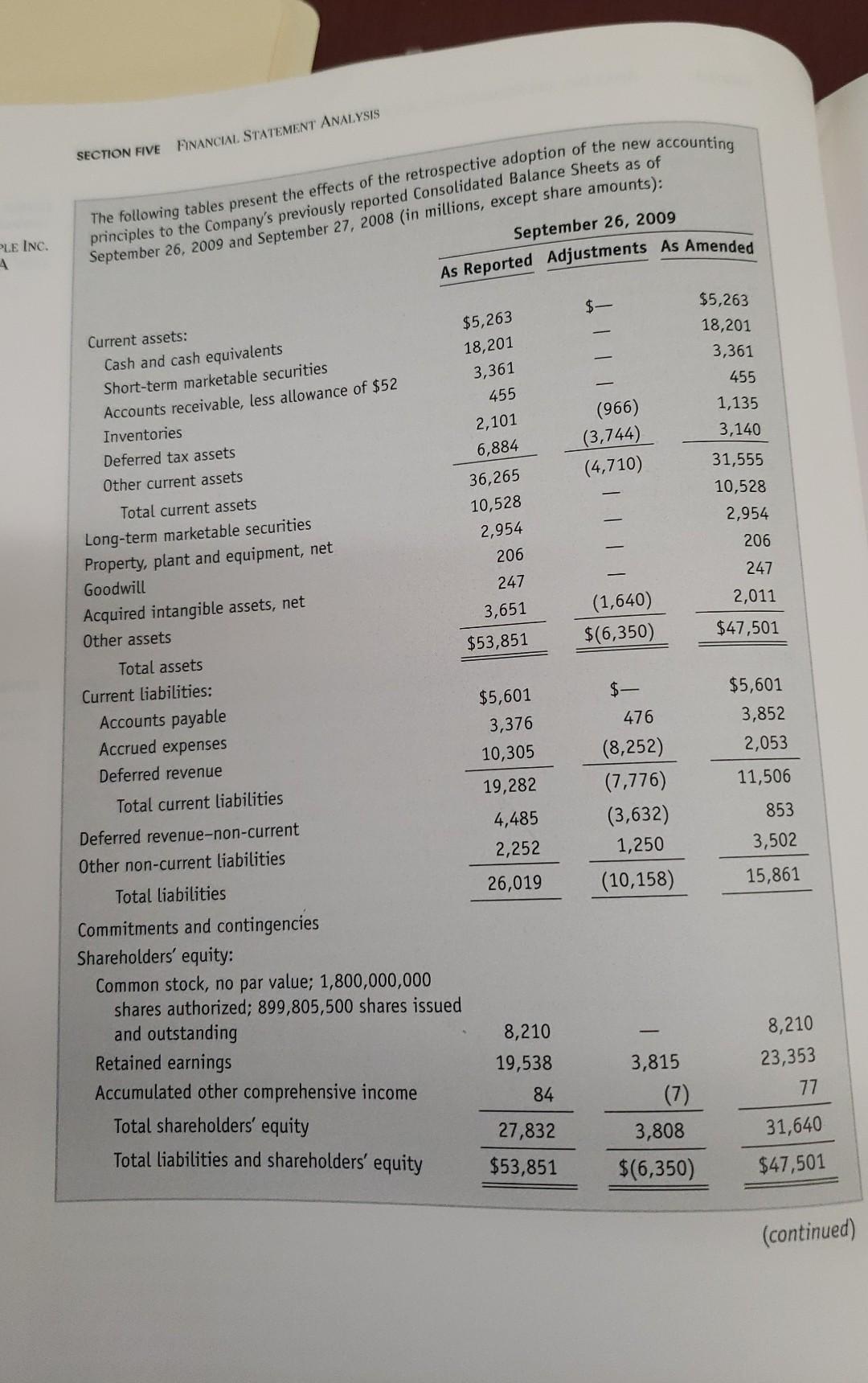

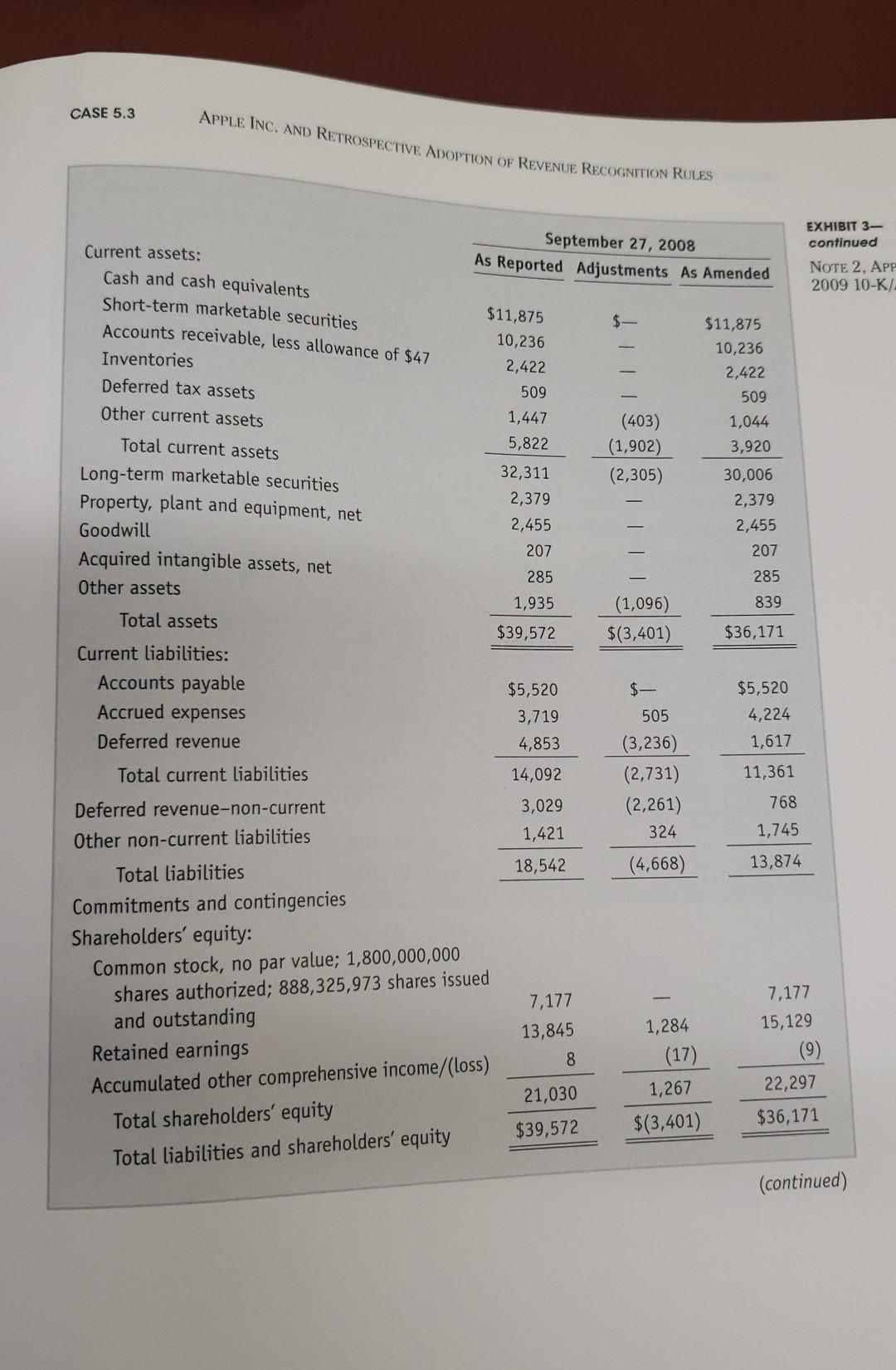

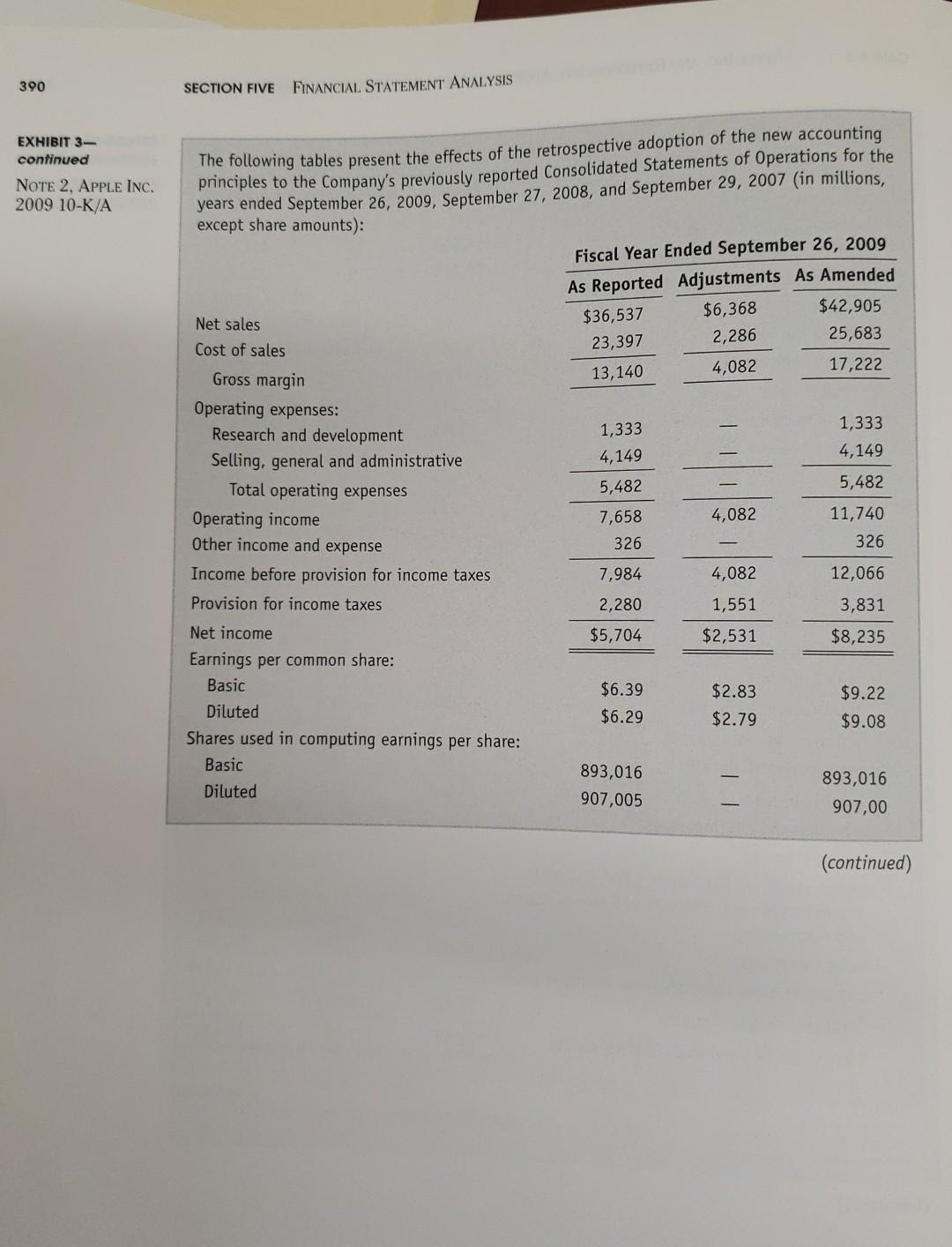

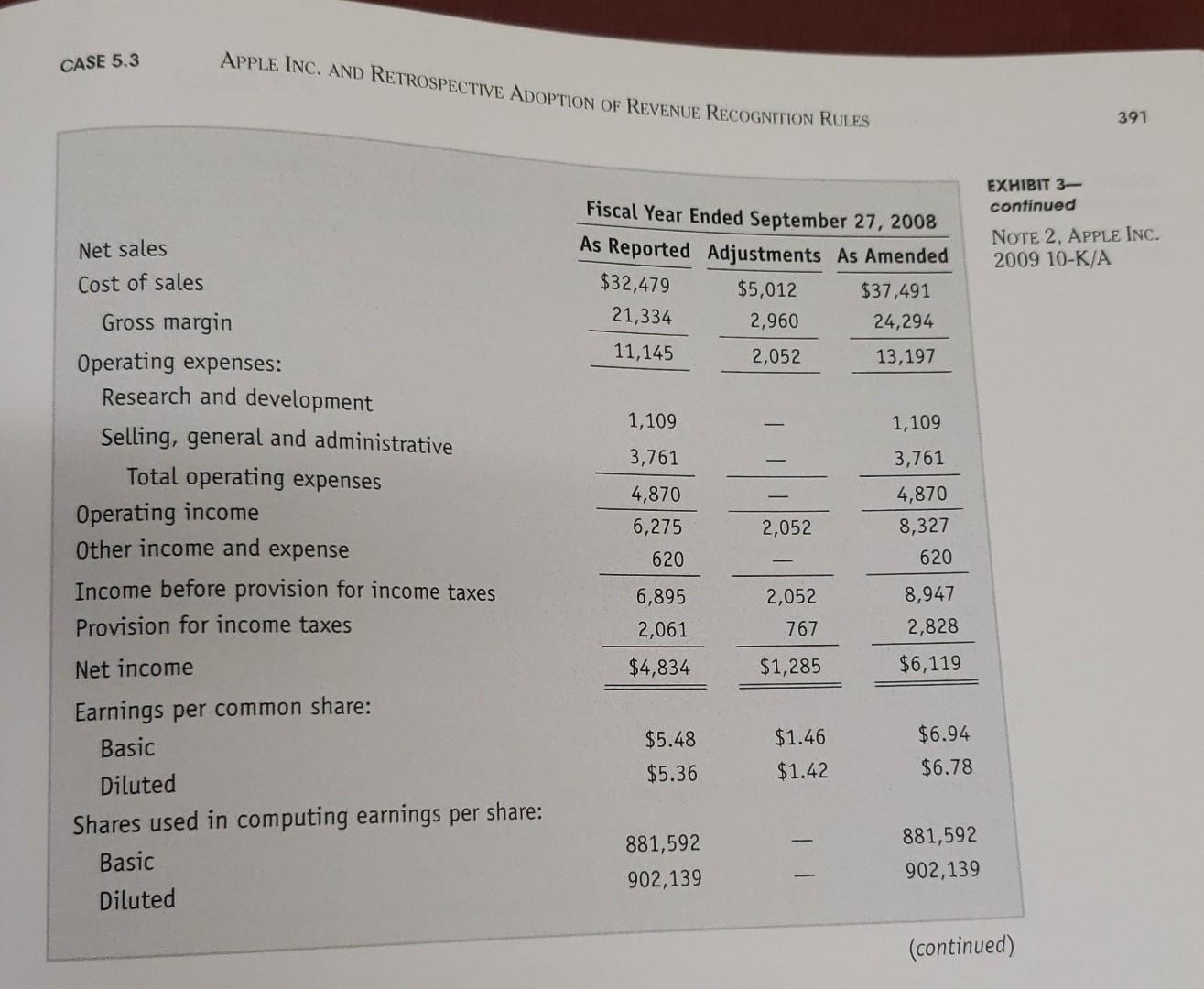

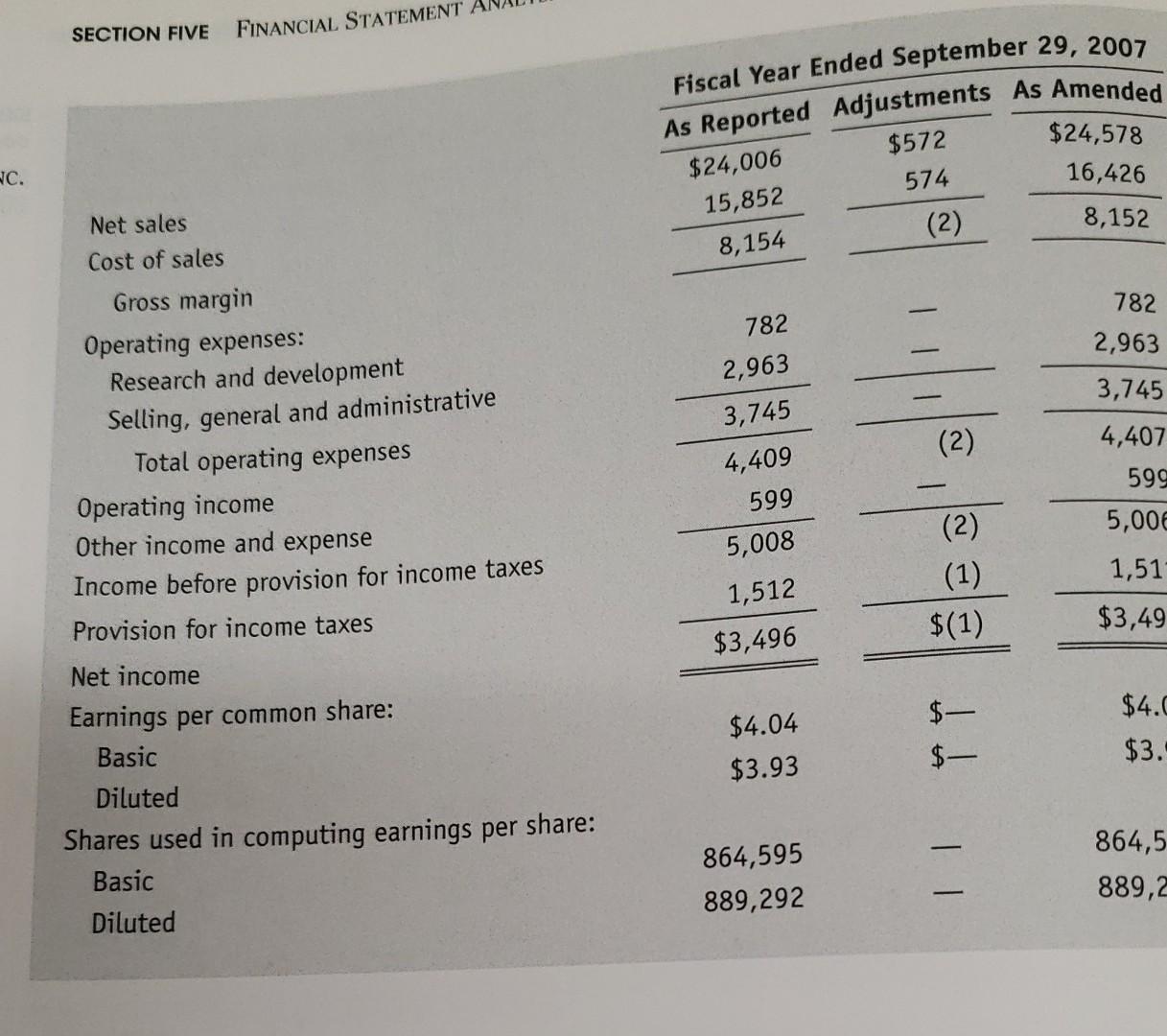

FINANCIAL STATEMENT ANALYSIS SECTION FIVE The following tables present the effects of the retrospective adoption of the new accounting principles to the Company's previously reported Consolidated Balance Sheets as of September 26, 2009 and September 27, 2008 (in millions, except share amounts): PLE INC. 4 September 26, 2009 As Reported Adjustments As Amended $ $5,263 18,201 3,361 455 2,101 6,884 (966) (3,744) (4,710) Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowance of $52 Inventories Deferred tax assets Other current assets Total current assets Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other assets $5,263 18,201 3,361 455 1,135 3,140 31,555 10,528 2,954 206 247 36,265 10,528 2,954 206 247 3,651 2,011 (1,640) $(6,350) $47,501 $53,851 Total assets Current liabilities: Accounts payable Accrued expenses Deferred revenue Total current liabilities Deferred revenue-non-current Other non-current liabilities Total liabilities $5,601 3,852 2,053 $5,601 3,376 10,305 19,282 11,506 476 (8,252) (7,776) (3,632) 1,250 (10,158) 4,485 2,252 853 3,502 15,861 26,019 8,210 Commitments and contingencies Shareholders' equity: Common stock, no par value; 1,800,000,000 shares authorized; 899,805,500 shares issued and outstanding Retained earnings Accumulated other comprehensive income Total shareholders' equity Total liabilities and shareholders' equity 19,538 84 8,210 23,353 77 3,815 (7) 3,808 $(6,350) 31,640 27,832 $53,851 $47,501 (continued) CASE 5.3 APPLE INC. AND RETROSPECTIVE ADOPTION OF REVENUE RECOGNITION RULES September 27, 2008 As Reported Adjustments As Amended EXHIBIT 3- continued NOTE 2, APP 2009 10-KA $11,875 10,236 $ 2, 422 509 1,447 Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowance of $47 Inventories Deferred tax assets Other current assets Total current assets Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other assets Total assets 5,822 (403) (1,902) (2,305) $11,875 10,236 2,422 509 1,044 3,920 30,006 2,379 2,455 207 32,311 2,379 2,455 207 285 285 1,935 839 (1,096) $(3,401) $39,572 $36,171 Current liabilities: Accounts payable Accrued expenses Deferred revenue $5,520 3,719 4,853 $5,520 4,224 1,617 Total current liabilities $ 505 (3,236) (2,731) (2,261) 324 (4,668) 14,092 3,029 1,421 11,361 768 1,745 13,874 18,542 Deferred revenue-non-current Other non-current liabilities Total liabilities Commitments and contingencies Shareholders' equity: Common stock, no par value; 1,800,000,000 shares authorized; 888,325,973 shares issued and outstanding Retained earnings Accumulated other comprehensive income/(Loss) Total shareholders' equity Total liabilities and shareholders' equity 7,177 13,845 7,177 15,129 (9) 22,297 1,284 (17) 1,267 $(3,401) 8 21,030 $39,572 $36,171 (continued) 390 SECTION FIVE FINANCIAL STATEMENT ANALYSIS EXHIBIT 3- continued NOTE 2, APPLE INC. 2009 10-K/A The following tables present the effects of the retrospective adoption of the new accounting principles to the Company's previously reported Consolidated Statements of Operations for the years ended September 26, 2009, September 27, 2008, and September 29, 2007 (in millions, except share amounts): Fiscal Year Ended September 26, 2009 As Reported Adjustments As Amended $6,368 $42,905 $36,537 Net sales 2,286 23,397 25,683 Cost of sales 13,140 4,082 17,222 Gross margin Operating expenses: 1,333 1,333 Research and development 4,149 4,149 Selling, general and administrative Total operating expenses 5,482 5,482 Operating income 7,658 4,082 11,740 Other income and expense 326 326 Income before provision for income taxes 7,984 4,082 12,066 Provision for income taxes 2,280 1,551 3,831 Net income $5,704 $2,531 $8,235 Earnings per common share: Basic $6.39 $2.83 $9.22 Diluted $6.29 $2.79 $9.08 Shares used in computing earnings per share: Basic 893,016 893,016 Diluted 907,005 907,00 (continued) CASE 5.3 APPLE INC. AND RETROSPECTIVE ADOPTION OF REVENUE RECOGNITION RULES 391 EXHIBIT 3 continued NOTE 2, APPLE INC. 2009 10-K/A Net sales Cost of sales Fiscal Year Ended September 27, 2008 As Reported Adjustments As Amended $32,479 $5,012 $37,491 21,334 2,960 24,294 11,145 2,052 13,197 1,109 1,109 Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income and expense Income before provision for income taxes Provision for income taxes 3,761 4,870 6,275 620 3,761 4,870 8,327 620 2,052 6,895 2,061 2,052 767 8,947 2,828 Net income $4,834 $1,285 $6,119 $5.48 $1.46 $1.42 $6.94 $6.78 $5.36 Earnings per common share: Basic Diluted Shares used in computing earnings per share: Basic Diluted 881,592 902,139 881,592 902,139 (continued) SECTION FIVE FINANCIAL STATEMENT Fiscal Year Ended September 29, 2007 As Reported Adjustments As Amended $24,006 $572 15,852 574 8,154 (2) $24,578 16,426 C. 8,152 782 2,963 Il 3,745 Net sales Cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income and expense Income before provision for income taxes Provision for income taxes 782 2,963 3,745 4,409 599 5,008 ) (2) - (2 ) 4,407 599 5,00 - 1,512 (1) $(1) 1,51 $3,49 $3,496 $4.04 $3.93 $- $- $4.C $3. Net income Earnings per common share: Basic Diluted Shares used in computing earnings per share: Basic Diluted 864,595 889,292 864,5 889,2 EXHIB NOTE 2009 Note 2-Retrospective Adoption of New Accounting Principles In September 2009, the FASB amended the accounting standards related to revenue recognition for arrangements with multiple deliverables and arrangements that include software elements. In the first quarter of 2010, the Company adopted the new accounting principles on a retrospective basis. The Company believes retrospective adoption provides the most comparable and useful financial information for financial statement users, is more consistent with the information the Company's management uses to evaluate its business, and better reflects the underlying economic performance of the Company. The financial statements and notes to the financial statements presented herein have been adjusted to reflect the retrospective adoption of the new accounting principles. Note 1, "Summary of Significant Accounting Policies" under the subheadings "Basis of Presentation and Preparation" and "Revenue Recognition" of this Form 10-K provides additional information on the Company's change in accounting resulting from the adoption of the new accounting principles and the Company's revenue recognition accounting policy. (continued)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts