Question: Explain the consequences each valuation method may have on the valuation of the inventory in the above scenario and the determination of the net income

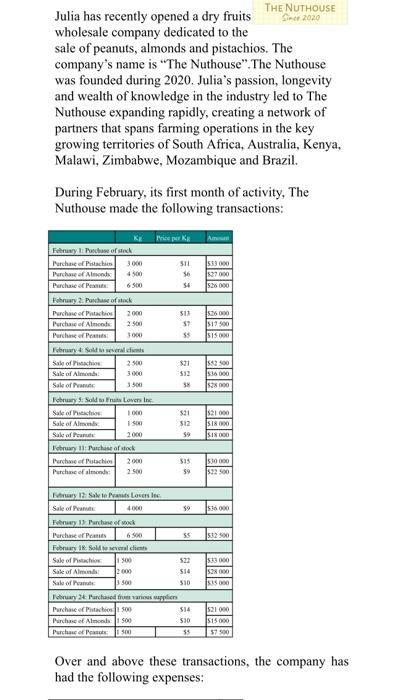

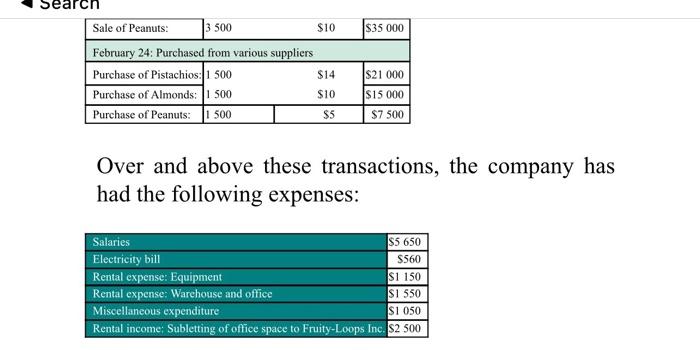

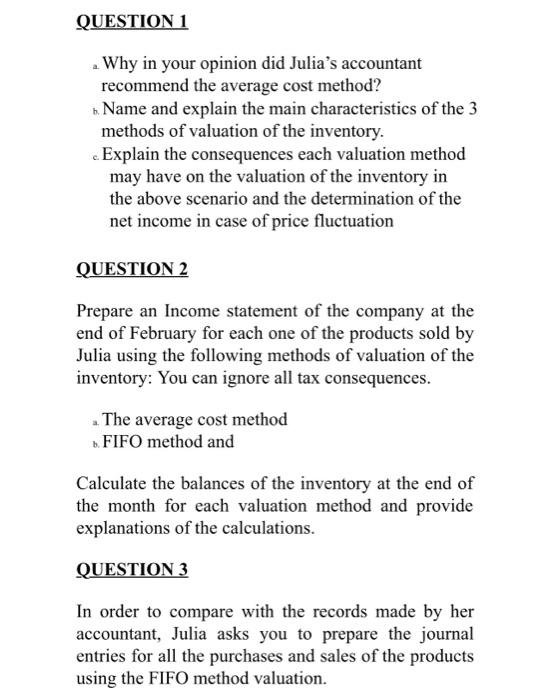

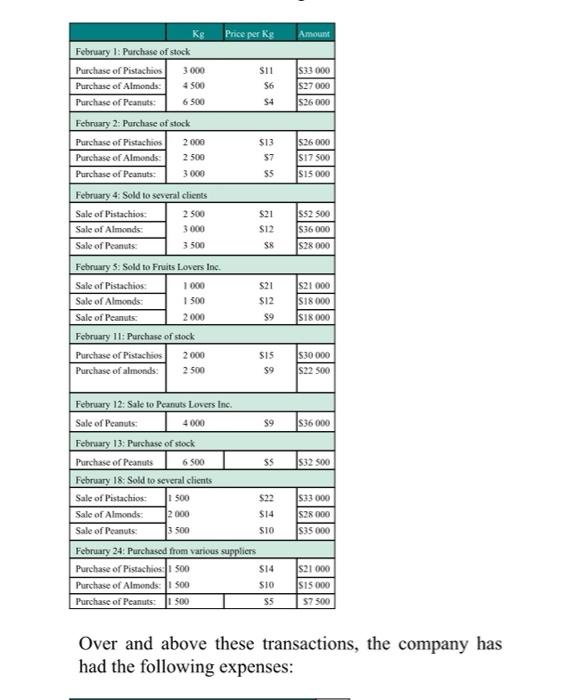

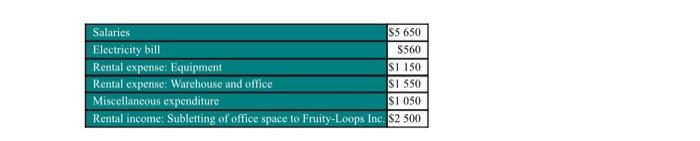

Julia has recently opened a dry fruits THE NUTHOUSE wholesale company dedicated to the sale of peanuts, almonds and pistachios. The company's name is "The Nuthouse". The Nuthouse was founded during 2020. Julia's passion, longevity and wealth of knowledge in the industry led to The Nuthouse expanding rapidly, creating a network of partners that spans farming operations in the key growing territories of South Africa, Australia, Kenya, Malawi, Zimbabwe, Mozambique and Brazil. During February, its first month of activity, The Nuthouse made the following transactions: Over and above these transactions, the company has had the following expenses: Over and above these transactions, the company has had the following expenses: a. Why in your opinion did Julia's accountant recommend the average cost method? b. Name and explain the main characteristics of the 3 methods of valuation of the inventory. c. Explain the consequences each valuation method may have on the valuation of the inventory in the above scenario and the determination of the net income in case of price fluctuation QUESTION 2 Prepare an Income statement of the company at the end of February for each one of the products sold by Julia using the following methods of valuation of the inventory: You can ignore all tax consequences. a. The average cost method b. FIFO method and Calculate the balances of the inventory at the end of the month for each valuation method and provide explanations of the calculations. QUESTION 3 In order to compare with the records made by her accountant, Julia asks you to prepare the journal entries for all the purchases and sales of the products using the FIFO method valuation. Over and above these transactions, the company has had the following expenses: \begin{tabular}{|l|r|} \hline Salaries & $5650 \\ \hline Electricity bill & $560 \\ \hline Rental expense: Equipment & $1150 \\ \hline Rental expense: Warehouse and office & $1550 \\ \hline Miseellancous expenditure & $1050 \\ \hline Rental income: Subletting of office space to Fruity-Loops Inc. & $2500 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts