Question: Explain the correct Answer. Don't use charGPT/AI bot other wise down vote In the current year, Sandra rented her vacation home for 75 days, used

Explain the correct Answer. Don't use charGPT/AI bot other wise down vote

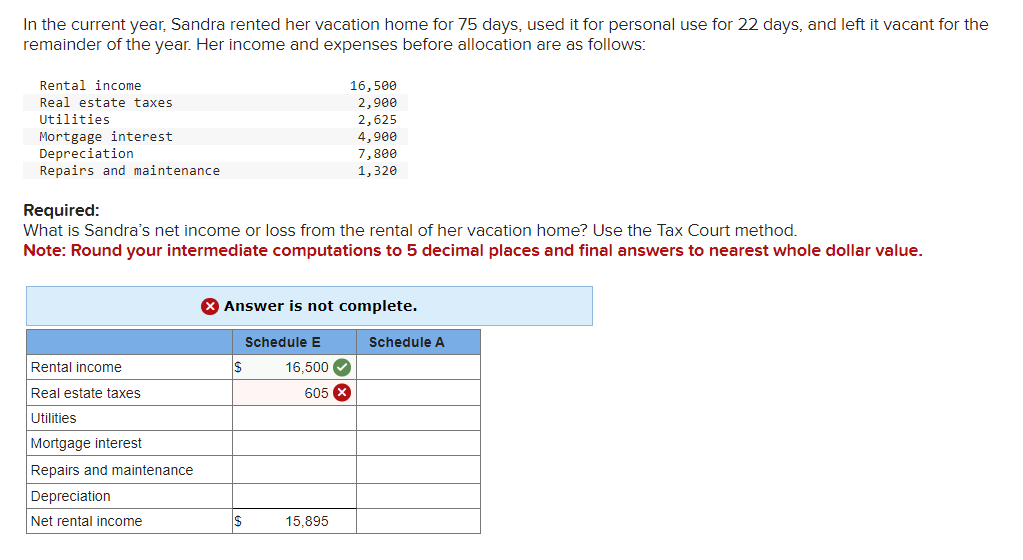

In the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income 16,533 Real estate taxes 2,933 Utilities 2,625 Mortgage interest 4,933 Depreciation 7,833 Repairs and maintenance 1,323 Required: What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and nal answers to nearest whole dollar value. 6 Answer is not complete. Rental income 5: 16.5000 Real estate taxes 605 9 Utilities Mortgage interest Repairs and maintenance De preciation Net rental income :8 15.895

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts