Question: Explain the difference between direct costs and indirect cost Howard Manufacturing Company had the following account balances for the quarter ending March 31, unless otherwise

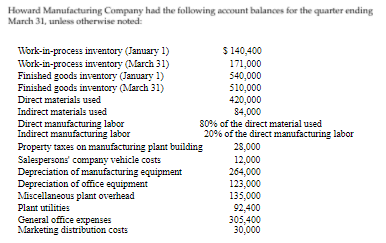

Explain the difference between direct costs and indirect cost Howard Manufacturing Company had the following account balances for the quarter ending March 31, unless otherwise noted: Work-in-process inventory (January 1) $ 140,400 Work-in-process inventory (March 31) 171,000 Finished goods inventory (January 1) 540,000 Finished goods inventory (March 31) 510,000 Direct materials used 420,000 Indirect materials used 84,000 Direct manufacturing labor 80% of the direct material used Indirect manufacturing labor 20% of the direct manufacturing labor Property taxes on manufacturing plant building 28,000 Salespersons' company vehicle costs 12,000 Depreciation of manufacturing equipment 264,000 Depreciation of office equipment 123,000 Miscellaneous plant overhead 135,000 Plant utilities 92,400 General office expenses 305,400 Marketing distribution costs 30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts