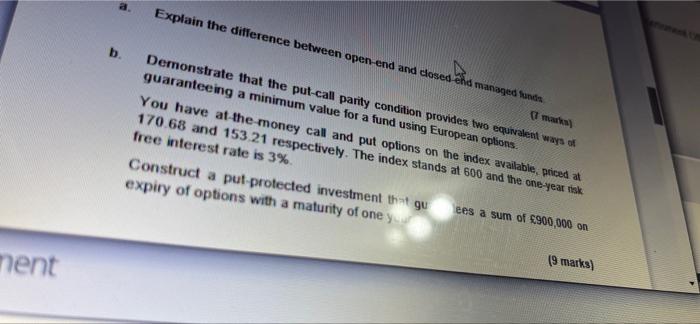

Question: Explain the difference between open-end and closed end managed funds mark b. Demonstrate that the put call parity condition provides two equivalent ways of guaranteeing

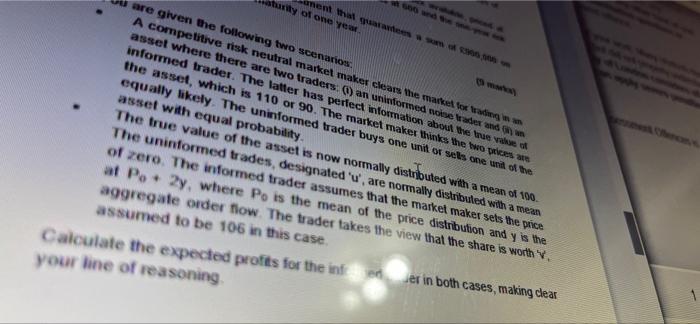

Explain the difference between open-end and closed end managed funds mark b. Demonstrate that the put call parity condition provides two equivalent ways of guaranteeing a minimum value for a fund using European options. You have at the money cal and put options on the index available, priced at 170.68 and 153 21 respectively. The index stands at 600 and the one-year risk free interest rate is 3% Construct a put protected investment that gu ees a sum of $900,000 on expiry of options with a maturity of one y ment (9 marks) nem talgud any of one year are given the following two scenarios A competitive risk neutral market maker clears live market for dig asset where there are two traders: ) an witormed wone trade and informed trader. The latter has perfect information about the web the asset, which is 110 or 90. The market makes thinks the two piensa equally likely. The uniformed trader buys one unit sets one unit of the asset with equal probability The true value of the asset is now normally distributed with a mean of 100. The uninformed trades, designated 'u', are normally distributed with a mean of zero. The informed trader assumes that the market maker sets the price af Po. 2y, where Po is the mean of the price distribution and y is the aggregate order flow. The trader takes the view that the share is worth Y assumed to be 106 in this case, Calculate the expected profits for the in er in both cases, making clear your line of reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts