Question: Explain the difference between return on equity and return on assets. A . Return on equity is computed as net income divided by average stockholders'

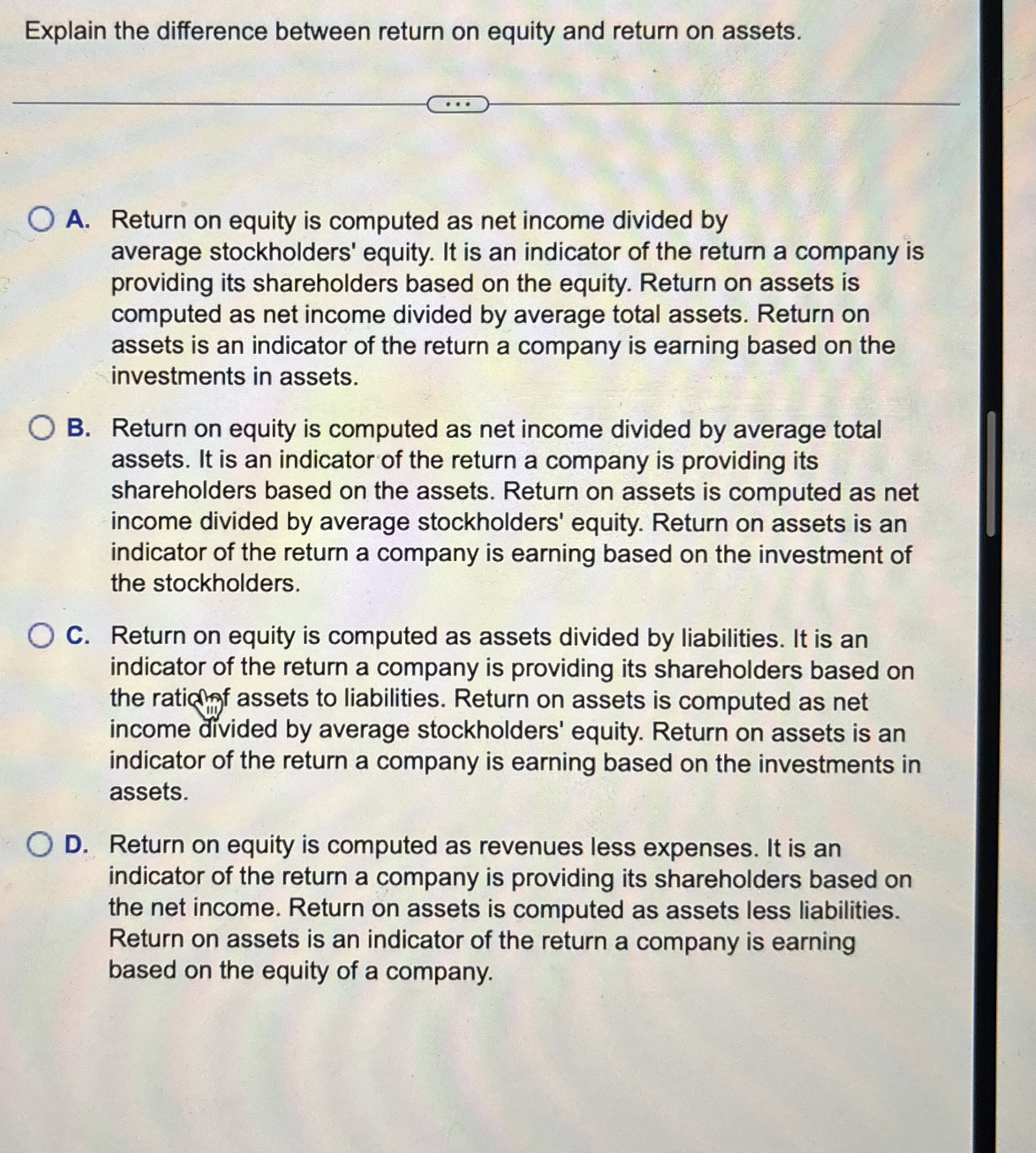

Explain the difference between return on equity and return on assets.

A Return on equity is computed as net income divided by average stockholders' equity. It is an indicator of the return a company is providing its shareholders based on the equity. Return on assets is computed as net income divided by average total assets. Return on assets is an indicator of the return a company is earning based on the investments in assets.

B Return on equity is computed as net income divided by average total assets. It is an indicator of the return a company is providing its shareholders based on the assets. Return on assets is computed as net income divided by average stockholders' equity. Return on assets is an indicator of the return a company is earning based on the investment of the stockholders.

C Return on equity is computed as assets divided by liabilities. It is an indicator of the return a company is providing its shareholders based on the ration assets to liabilities. Return on assets is computed as net income divided by average stockholders' equity. Return on assets is an indicator of the return a company is earning based on the investments in assets.

D Return on equity is computed as revenues less expenses. It is an indicator of the return a company is providing its shareholders based on the net income. Return on assets is computed as assets less liabilities. Return on assets is an indicator of the return a company is earning based on the equity of a company.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock