Question: explain the difference between these two income sources in terms of their actual and discounted cash-flows. Describe the situations when an investor would favour one

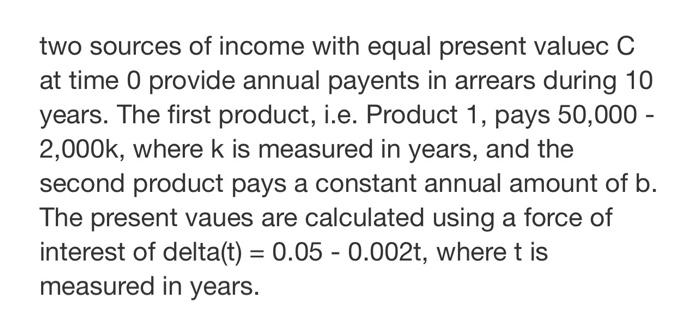

two sources of income with equal present valuec C at time 0 provide annual payents in arrears during 10 years. The first product, i.e. Product 1, pays 50,000 - 2,000k, where k is measured in years, and the second product pays a constant annual amount of b. The present vaues are calculated using a force of interest of delta(t) = 0.05 -0.002t, where t is measured in years. =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts