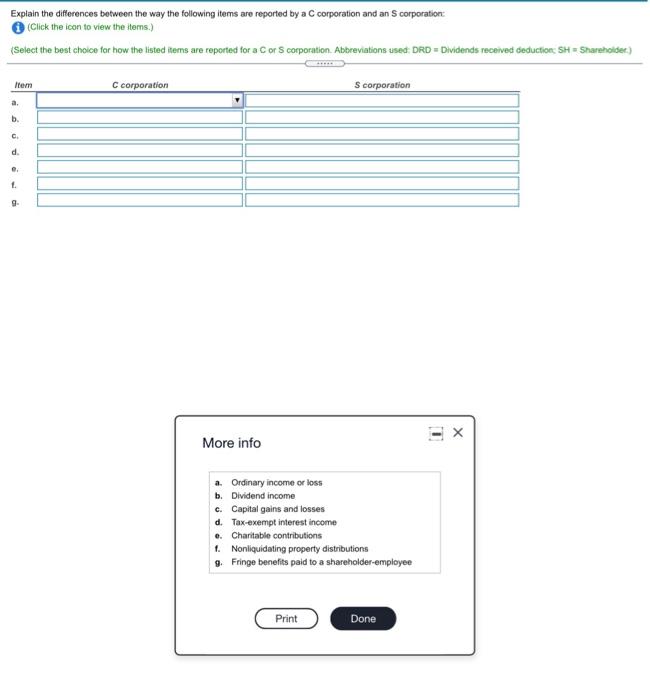

Question: Explain the differences between the way the following items are reported by a C corporation and an S corporation: C Corporation options for each: S

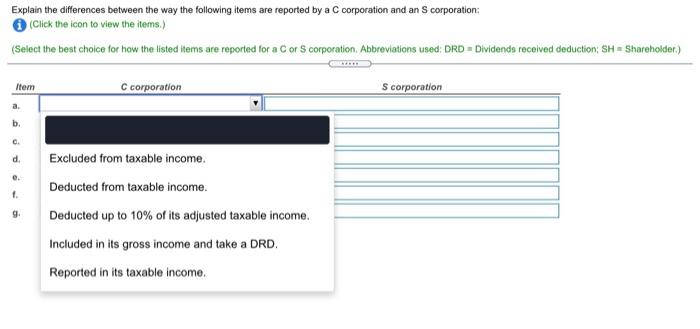

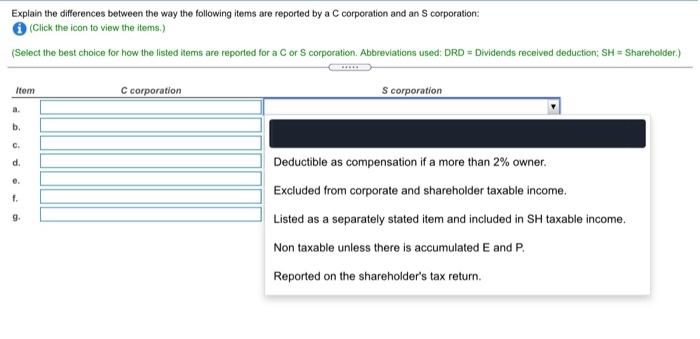

Explain the differences between the way the following items are reported by a C corporation and an Scorporation: (Click the icon to view the items.) (Select the best choice for how the listed items are reported for a cor corporation Abbreviations used DRDDividends received deduction: SH Shareholder.) Item C corporation S corporation a. b. C. d e t 9 X More info a. Ordinary income or loss b. Dividend income c. Capital gains and losses d. Tax-exempt interest income 0. Charitable contributions Nonliquidating property distributions 9. Fringe benefits paid to a shareholder-employee Print Done Explain the differences between the way the following items are reported by a C corporation and an corporation: Click the icon to view the items.) (Select the best choice for how the listed items are reported for a Cor corporation, Abbreviations used: DRD = Dividends received deduction: SH - Shareholder.) Item C corporation S corporation a. b. e d 0. 1. 9 Excluded from taxable income. Deducted from taxable income. Deducted up to 10% of its adjusted taxable income. Included in its gross income and take a DRD. Reported in its taxable income. Explain the differences between the way the following items are reported by a C corporation and an corporation (Click the icon to view the items.) (Select the best choice for how the listed items are reported for a Cor corporation. Abbreviations used: DRD = Dividends received deduction; SH = Shareholder.) *** Item C corporation S corporation b. C. d. f. 9. Deductible as compensation if a more than 2% owner. Excluded from corporate and shareholder taxable income. Listed as a separately stated item and included in SH taxable income. Non taxable unless there is accumulated E and P. Reported on the shareholder's tax return. Explain the differences between the way the following items are reported by a C corporation and an Scorporation: (Click the icon to view the items.) (Select the best choice for how the listed items are reported for a cor corporation Abbreviations used DRDDividends received deduction: SH Shareholder.) Item C corporation S corporation a. b. C. d e t 9 X More info a. Ordinary income or loss b. Dividend income c. Capital gains and losses d. Tax-exempt interest income 0. Charitable contributions Nonliquidating property distributions 9. Fringe benefits paid to a shareholder-employee Print Done Explain the differences between the way the following items are reported by a C corporation and an corporation: Click the icon to view the items.) (Select the best choice for how the listed items are reported for a Cor corporation, Abbreviations used: DRD = Dividends received deduction: SH - Shareholder.) Item C corporation S corporation a. b. e d 0. 1. 9 Excluded from taxable income. Deducted from taxable income. Deducted up to 10% of its adjusted taxable income. Included in its gross income and take a DRD. Reported in its taxable income. Explain the differences between the way the following items are reported by a C corporation and an corporation (Click the icon to view the items.) (Select the best choice for how the listed items are reported for a Cor corporation. Abbreviations used: DRD = Dividends received deduction; SH = Shareholder.) *** Item C corporation S corporation b. C. d. f. 9. Deductible as compensation if a more than 2% owner. Excluded from corporate and shareholder taxable income. Listed as a separately stated item and included in SH taxable income. Non taxable unless there is accumulated E and P. Reported on the shareholder's tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts