Question: Explain the following example: Performance Evaluation, Cost Minimization, and Transfer Pricing Cost minimization - Example Padre Inc., a U.S. company, has two subsidiaries, Hijo and

Explain the following example:

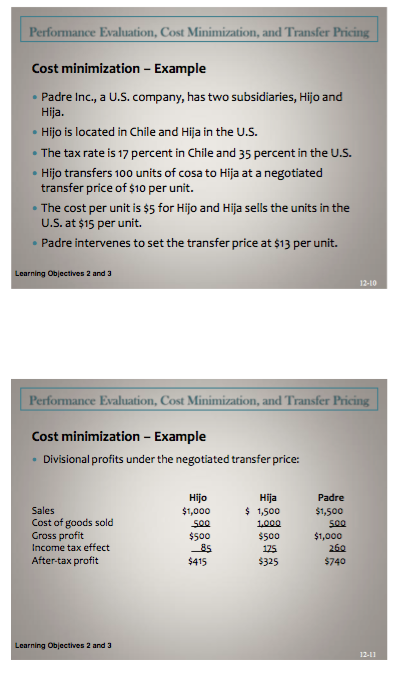

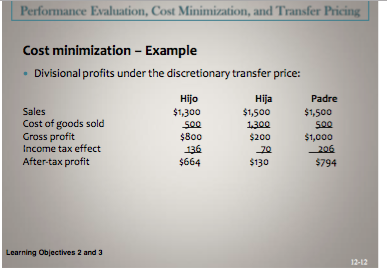

Performance Evaluation, Cost Minimization, and Transfer Pricing Cost minimization - Example Padre Inc., a U.S. company, has two subsidiaries, Hijo and Hija. Hijo is located in Chile and Hija in the U.S. The tax rate is 17 percent in Chile and 35 percent in the U.S. Hijo transfers 100 units of cosa to Hija at a negotiated transfer price of $10 per unit. The cost per unit is $5 for Hijo and Hija sells the units in the U.S. at $15 per unit. Padre intervenes to set the transfer price at $13 per unit. Learning Objectives 2 and 3 Performance Evaluation, Cost Minimization, and Transfer Pricing Cost minimization - Example Divisional profits under the negotiated transfer price: Sales Cost of goods sold Gross profit Income tax effect After-tax profit Hijo $1,000 500 $500 Hija $ 1,500 1.000 $500 125 $325 Padre $1,500 500 $1,000 269 $740 85 $415 Learning Objectives 2 and 3 12-11 Performance Evaluation, Cost Minimization, and Transfer Pricing Cost minimization - Example Divisional profits under the discretionary transfer price: Sales Cost of goods sold Gross profit Income tax effect After-tax profit Hijo $1,300 Sog $800 136 $664 Hija $1,500 1.300 $200 20 $130 Padre $1,500 500 $1,000 206 $794 Learning Objectives 2 and 3 13-12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts