Question: Explain the key differences between forwards and futures. The spot price of oil is currently $128. An oil exporter enters into a forward contract

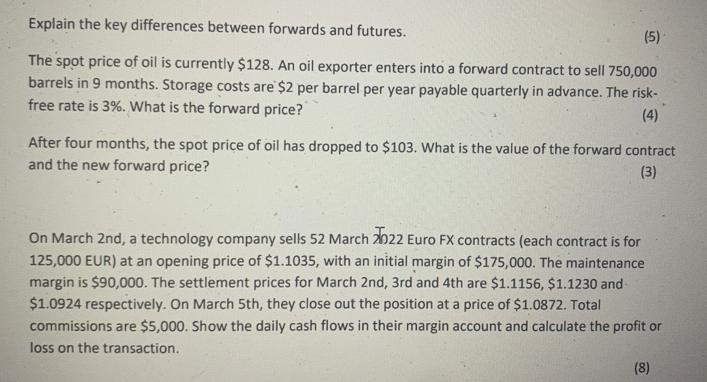

Explain the key differences between forwards and futures. The spot price of oil is currently $128. An oil exporter enters into a forward contract to sell 750,000 barrels in 9 months. Storage costs are $2 per barrel per year payable quarterly in advance. The risk- free rate is 3%. What is the forward price? (4) (5) After four months, the spot price of oil has dropped to $103. What is the value of the forward contract and the new forward price? (3) On March 2nd, a technology company sells 52 March 2022 Euro FX contracts (each contract is for 125,000 EUR) at an opening price of $1.1035, with an initial margin of $175,000. The maintenance margin is $90,000. The settlement prices for March 2nd, 3rd and 4th are $1.1156, $1.1230 and $1.0924 respectively. On March 5th, they close out the position at a price of $1.0872. Total commissions are $5,000. Show the daily cash flows in their margin account and calculate the profit or loss on the transaction. (8)

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Answer 1 The key differences between forwards and futures are Forwards are contracts between two par... View full answer

Get step-by-step solutions from verified subject matter experts