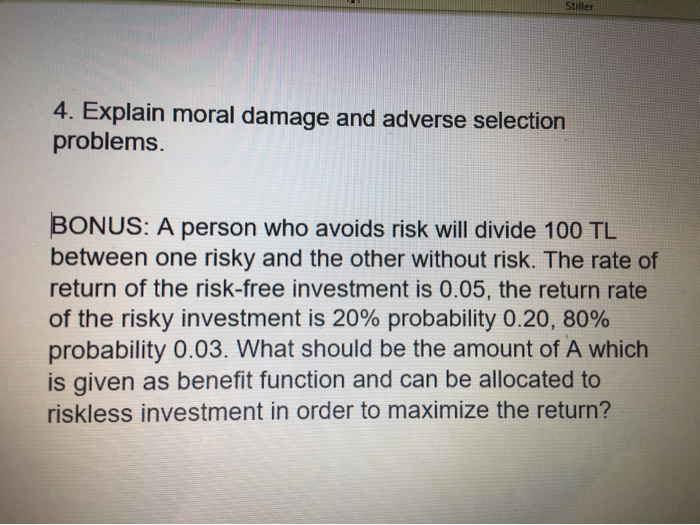

Question: explain the moral damage and adverse selection problems by using samples Stiller 4. Explain moral damage and adverse selection problems. BONUS: A person who avoids

Stiller 4. Explain moral damage and adverse selection problems. BONUS: A person who avoids risk will divide 100 TL between one risky and the other without risk. The rate of return of the risk-free investment is 0.05, the return rate of the risky investment is 20% probability 0.20, 80% probability 0.03. What should be the amount of A which is given as benefit function and can be allocated to riskless investment in order to maximize the return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts