Question: Explain the questions as attached below. 1. We use the added variable technique to derive the variance ination factor (VIP). Consider a linear model of

Explain the questions as attached below.

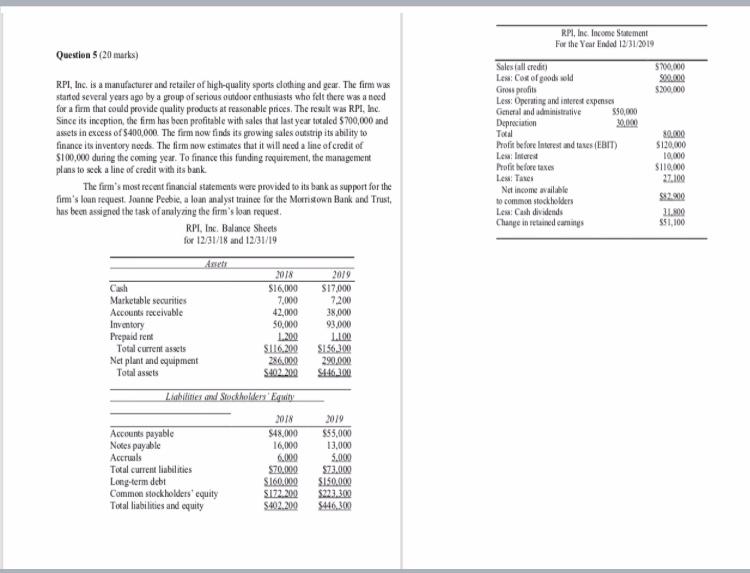

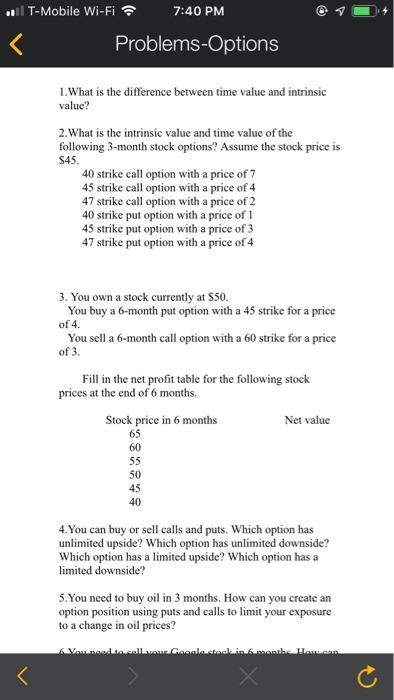

1. We use the added variable technique to derive the variance ination factor (VIP). Consider a linear model of the form 91' =50+l31$1+l3213922+-"+}3p$a'p+zr, 5'3: 1:"'ana (1) where the errors are uncorrelated with mean zero and variance 02. Let X denote the n X p' predictor matrix and assume X is of full rank. We will derive the VIP for ip. The same derivation applies to any other coefcient simply by rearranging the columns of X. Let U denote the matrix containing the rst p' 1 columns of X and let z denote the the last column of X so that X = [U 2]. Then we can write the model in (1) as 50 x91 Y=[U z](,:J)+t-:=Ua+z6p+e with a: (2) x810. 1 Let 2 denote the vector of tted values from the least squares regression of z on the columns of U (Le. the regression of X.p on all the other variables), and let T : z 2 denote the residuals from that regression. Note that 'r' and 3 are not random, they are constant vectors obtained by linear transformations of z. (a) Show that the regression model in (2) can be rewritten in the form for some constant vector 6 of the same length as a. (Hint: z : i l 'r and 2? = U(UTU)_1UTz). (b) Show that UT? 2 0, a zero vector. (0) Obtain simplied expressions for the least squares estimators of 5 and 5?, showing, in particular, that 5,, : 'rTY/rT'r. (d) Based on Part (c) and the model assumptions, show that 0.2 ELK\"? _ is)? where :Eg-p is the LS tted value from regression X,D on the all the other predictor variables with an intercept. var(,p) : R.PI, Inc. Income Statement For the Year Endal 1231/2019 Question 5 (20 marks) Sales fall credit 5740.030 Los: Cost of goods cold RPI, Inc. is a manufacturer and retailer of high-quality sports clothing and gear. The firm was Gross profits started several years ago by a group of serious outdoor enthusiasts who fell there was a need Less: Operating and intered expenses for a firm that could provide quality products at reasonable prices, The result was RPI. Inc. General and administrative Since its inception, the firm has been profitable with sales that last year totaled $700,000 and Depreciation assets in excess of 5400,000. The firm now finds its growing sales outstrip its ability to Total finance its inventory needs. The firm now estimates that it will need a line of credit of Profit before Interest and taxes (EBIT) $100,000 during the coming year. To finance this funding requirement, the management Lew: Inand plans to seek a line of credit with its bank. Profit before taxes $110,100 Lew: Taxes 27.100 The firm's most recent financial statements were provided to its bank as support for the Net income available firm's loan request. Joanne Peebie, a loan analyst traince for the Morristown Bank and Trust, to common stockholders 5:2 900 has been assigned the task of analyzing the firm's loan request. Lew: Cash dividenda RPI, Inc. Balance Sheets Change in retained earnings $51,100 for 12/31/18 and 12/31/19 JO18 2019 Cash $16.030 $17,000 Marketable securities 7.00.0 7,200 Accounts receivable 42,000 38,000 Inventory 50.000 93.000 Prepaid rent 1.20:0 L.LOO Total current assets $116.200 $156 300 Net plant and equipment 286.000 290.0.00 Total assets $402 20 0 Limbifities ood Stockholders Equity Accounts payable $48.000 $55.000 Notes payable 16.000 13,000 Accruals 6.004 5.000 Total current liabilities $70.00-0 $73.0100 Long-term debt $160.000 $1502000 Common stockholders* equity $ 172. 20.0 $221300 Total liabilities and equity 5402.200 $463mIll T-Mobile Wi-Fi 7:40 PM A Problems-Options 1. What is the difference between time value and intrinsic value? 2. What is the intrinsic value and time value of the following 3-month stock options? Assume the stock price is $45. 40 strike call option with a price of 7 45 strike call option with a price of 4 47 strike call option with a price of 2 40 strike put option with a price of 1 45 strike put option with a price of 3 47 strike put option with a price of 4 3. You own a stock currently at $50. You buy a 6-month put option with a 45 strike for a price of 4. You sell a 6-month call option with a 60 strike for a price of 3. Fill in the net profit table for the following stock prices at the end of 6 months. Stock price in 6 months Net value 65 60 55 50 45 40 4. You can buy or sell calls and puts. Which option has unlimited upside? Which option has unlimited downside? Which option has a limited upside? Which option has a limited downside? 5. You need to buy oil in 3 months. How can you create an option position using puts and calls to limit your exposure to a change in oil prices? 6 You need to call your Gosale clock in f manthe How can A X C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts