Question: Explain the underlying reasoning for the following proposition in the context of company dividend policy: Dividend policy is strongly affected by tax rates on income

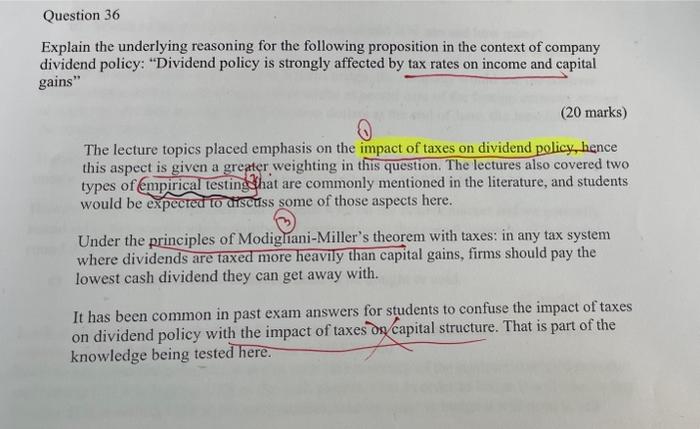

Explain the underlying reasoning for the following proposition in the context of company dividend policy: "Dividend policy is strongly affected by tax rates on income and capital gains" The lecture topics placed emphasis on the impact of taxes on dividend policy, hence this aspect is given a greater weighting in this question. The lectures also covered two types of empirical testing fhat are commonly mentioned in the literature, and students would be expecred to discuss some of those aspects here. Under the principles of Modiglani-Miller's theorem with taxes: in any tax system where dividends are taxed more heavily than capital gains, firms should pay the lowest cash dividend they can get away with. It has been common in past exam answers for students to confuse the impact of taxes on dividend policy with the impact of taxes on capital structure. That is part of the knowledge being tested here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts