Question: explain these problems Problems with the CAPM 1. Can we truly observe measure the return of a market portfolio? 2. When testing whether explains existing

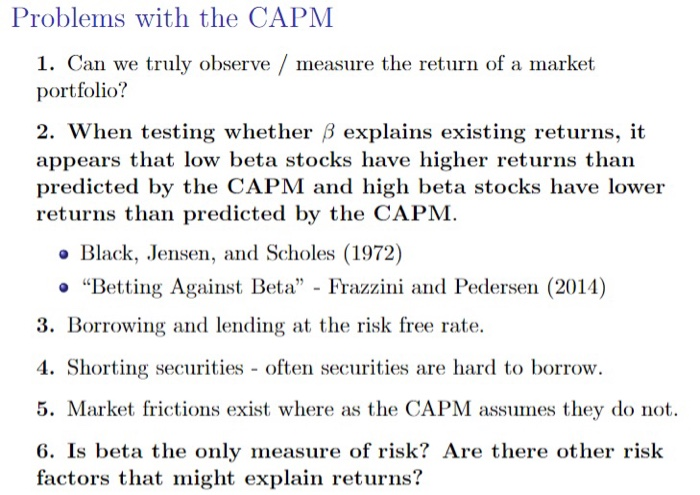

Problems with the CAPM 1. Can we truly observe measure the return of a market portfolio? 2. When testing whether explains existing returns, it appears that low beta stocks have higher returns than predicted by the CAPM and high beta stocks have lower returns than predicted by the CAPM. o Black, Jensen, and Scholes (1972) o "Betting Against Beta" Frazzini and Pedersen (2014) 3. Borrowing and lending at the risk free rate. 4. Shorting securities often securities are hard to borrow. 5. Market frictions exist where as the CAPM assumes they do not. 6. Is beta the only measure of risk? Are there other risk factors that might explain returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts