Question: explain this in excel with formulas please 1) Below are details of a semiannual bond. Par value = 1000; Maturity 4 years; Market rate if

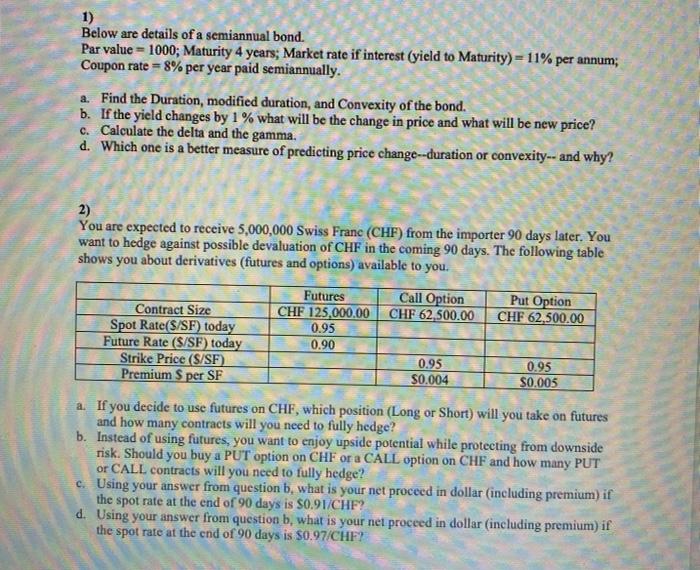

1) Below are details of a semiannual bond. Par value = 1000; Maturity 4 years; Market rate if interest (yield to Maturity) = 11% per annum; Coupon rate = 8% per year paid semiannually. a. Find the Duration, modified duration, and Convexity of the bond. b. If the yield changes by 1 % what will be the change in price and what will be new price? c. Calculate the delta and the gamma. d. Which one is a better measure of predicting price change--duration or convexity-- and why? 2) You are expected to receive 5,000,000 Swiss Franc (CHF) from the importer 90 days later. You want to hedge against possible devaluation of CHF in the coming 90 days. The following table shows you about derivatives (futures and options) available to you. Futures CHF 125,000.00 0.95 0.90 Call Option CHF 62.500.00 Put Option CHF 62,500.00 Contract Size Spot Rate(S/SF) today Future Rate (S/SF) today Strike Price (S/SF) Premium S per SF 0.95 S0.004 0.95 $0.005 a. If you decide to use futures on CHF, which position (Long or Short) will you take on futures and how many contracts will you need to fully hedge? b. Instead of using futures, you want to enjoy upside potential while protecting from downside risk. Should you buy a PUT option on CHF or a CALL option on CHF and how many PUT or CALL contracts will you need to fully hedge? c. Using your answer from question b, what is your net proceed in dollar (including premium) if the spot rate at the end of 90 days is $0.91/CHF? d. Using your answer from question b, what is your net proceed in dollar (including premium) if the spot rate at the end of 90 days is $0.97/CHF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts