Question: EXPLAIN THIS TABLE OF MARKETTABLE SECURITIES CHAPTER 14 Working Capital and Current Assets Management 625 TABLE 14.5 Features of Marketable Securities Issuer Description Initial maturity

EXPLAIN THIS TABLE OF MARKETTABLE SECURITIES

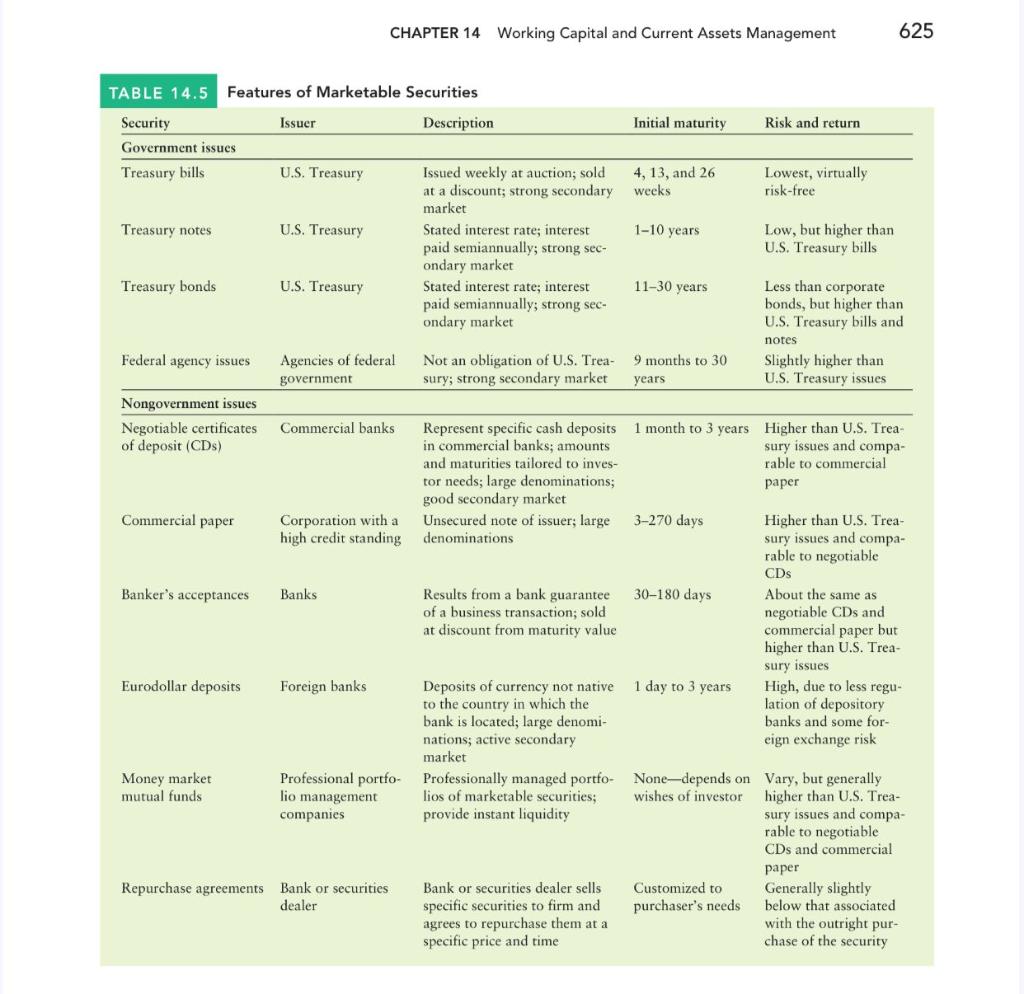

CHAPTER 14 Working Capital and Current Assets Management 625 TABLE 14.5 Features of Marketable Securities Issuer Description Initial maturity Risk and return Security Government issues Treasury bills U.S. Treasury 4, 13, and 26 weeks Lowest, virtually risk-free Treasury notes U.S. Treasury 1-10 years Issued weekly at auction; sold at a discount; strong secondary market Stated interest rate; interest paid semiannually; strong sec- ondary market Stated interest rate; interest paid semiannually; strong sec- ondary market Low, but higher than U.S. Treasury bills Treasury bonds U.S. Treasury 11-30 years Less than corporate bonds, but higher than U.S. Treasury bills and notes Slightly higher than U.S. Treasury issues Federal agency issues Agencies of federal government Not an obligation of U.S. Trea- sury; strong secondary market 9 months to 30 years Nongovernment issues Negotiable certificates of deposit (CDs) Commercial banks Commercial paper Corporation with a high credit standing Banker's acceptances Banks Represent specific cash deposits 1 month to 3 years Higher than U.S. Trea- in commercial banks; amounts sury issues and compa- and maturit tailo to inves- rable to commercial tor needs; large denominations; paper good secondary market Unsecured note of issuer; large 3-270 days Higher than U.S. Trea- denominations sury issues and compa- rable to negotiable CDs Results from a bank guarantee 30-180 days About the same as of a business transaction; sold negotiable CDs and at discount from maturity value commercial paper but higher than U.S. Trea- sury issues Deposits of currency not native 1 day to 3 years High, due to less regu- to the country in which the lation of depository bank is located; large denomi- banks and some for- nations; active secondary eign exchange risk market Professionally managed portfo- None-depends on Vary, but generally lios of marketable securities; wishes of investor higher than U.S. Trea- provide instant liquidity sury issues and compa- rable to negotiable CDs and commercial Eurodollar deposits Foreign banks Money market mutual funds Professional portfo- lio management companies paper Repurchase agreements Bank or securities dealer Bank or securities dealer sells specific securities to firm and agrees to repurchase them at a specific price and time Customized to purchaser's needs Generally slightly below that associated with the outright pur- chase of the security CHAPTER 14 Working Capital and Current Assets Management 625 TABLE 14.5 Features of Marketable Securities Issuer Description Initial maturity Risk and return Security Government issues Treasury bills U.S. Treasury 4, 13, and 26 weeks Lowest, virtually risk-free Treasury notes U.S. Treasury 1-10 years Issued weekly at auction; sold at a discount; strong secondary market Stated interest rate; interest paid semiannually; strong sec- ondary market Stated interest rate; interest paid semiannually; strong sec- ondary market Low, but higher than U.S. Treasury bills Treasury bonds U.S. Treasury 11-30 years Less than corporate bonds, but higher than U.S. Treasury bills and notes Slightly higher than U.S. Treasury issues Federal agency issues Agencies of federal government Not an obligation of U.S. Trea- sury; strong secondary market 9 months to 30 years Nongovernment issues Negotiable certificates of deposit (CDs) Commercial banks Commercial paper Corporation with a high credit standing Banker's acceptances Banks Represent specific cash deposits 1 month to 3 years Higher than U.S. Trea- in commercial banks; amounts sury issues and compa- and maturit tailo to inves- rable to commercial tor needs; large denominations; paper good secondary market Unsecured note of issuer; large 3-270 days Higher than U.S. Trea- denominations sury issues and compa- rable to negotiable CDs Results from a bank guarantee 30-180 days About the same as of a business transaction; sold negotiable CDs and at discount from maturity value commercial paper but higher than U.S. Trea- sury issues Deposits of currency not native 1 day to 3 years High, due to less regu- to the country in which the lation of depository bank is located; large denomi- banks and some for- nations; active secondary eign exchange risk market Professionally managed portfo- None-depends on Vary, but generally lios of marketable securities; wishes of investor higher than U.S. Trea- provide instant liquidity sury issues and compa- rable to negotiable CDs and commercial Eurodollar deposits Foreign banks Money market mutual funds Professional portfo- lio management companies paper Repurchase agreements Bank or securities dealer Bank or securities dealer sells specific securities to firm and agrees to repurchase them at a specific price and time Customized to purchaser's needs Generally slightly below that associated with the outright pur- chase of the security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts