Question: Explain what investment decision should be made for each project based on the NPV and IRR and why potential conflicts can arise when using these

Explain what investment decision should be made for each project based on the NPV and IRR and why potential conflicts can arise when using these investment appraisal techniques.

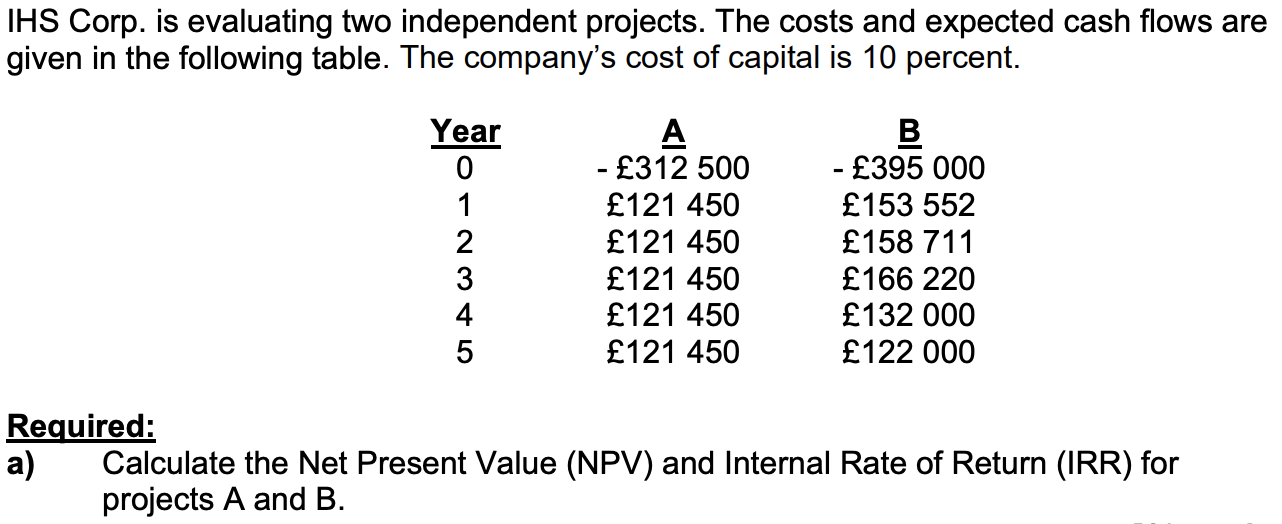

IHS Corp. is evaluating two independent projects. The costs and expected cash flows are given in the following table. The company's cost of capital is 10 percent. Year 0 1 2 3 4 5 A - 312 500 121 450 121 450 121 450 121 450 121 450 B - 395 000 153 552 158 711 166 220 132 000 122 000 Required: a) Calculate the Net Present Value (NPV) and Internal Rate of Return (IRR) for projects A and B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock