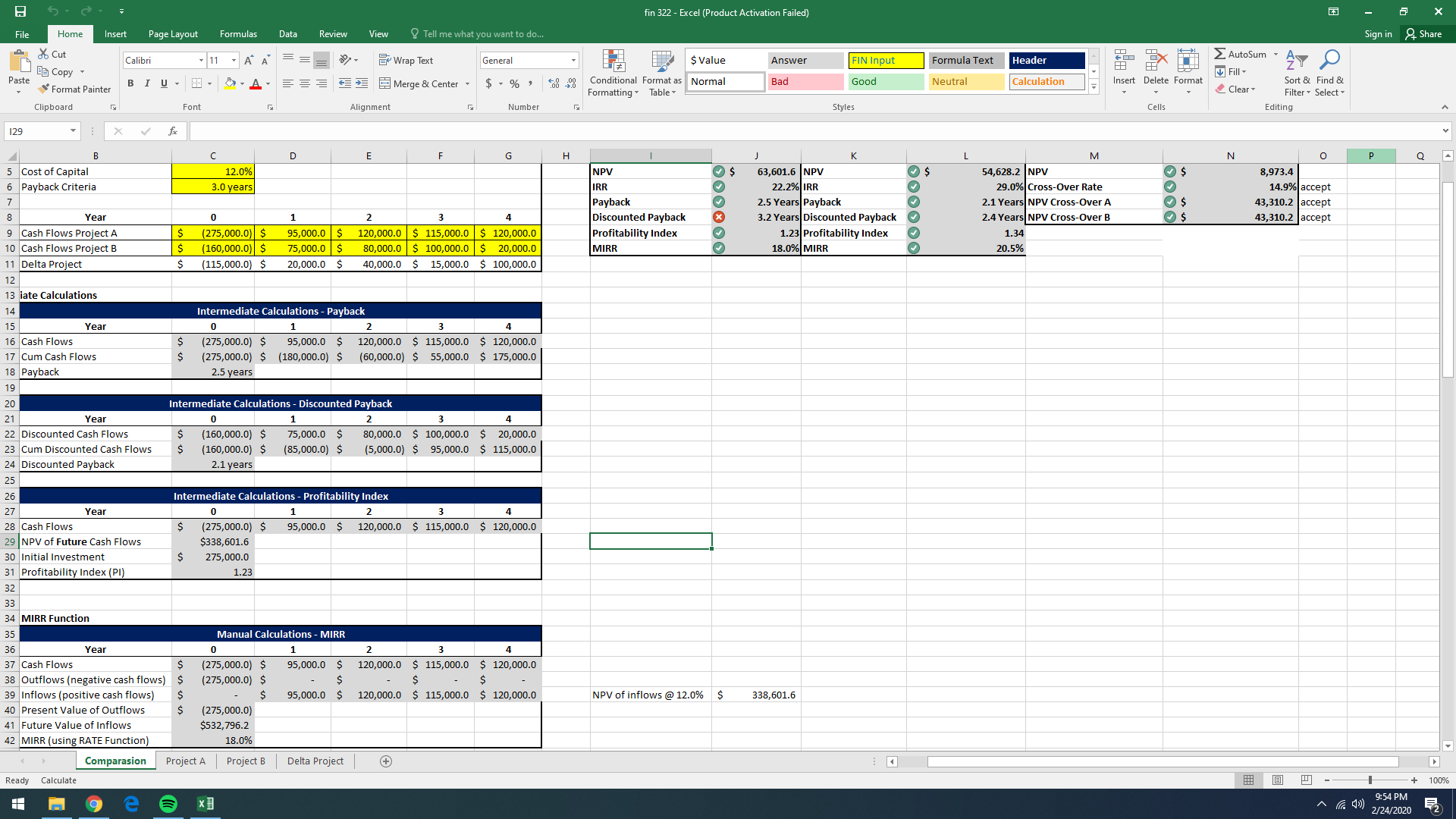

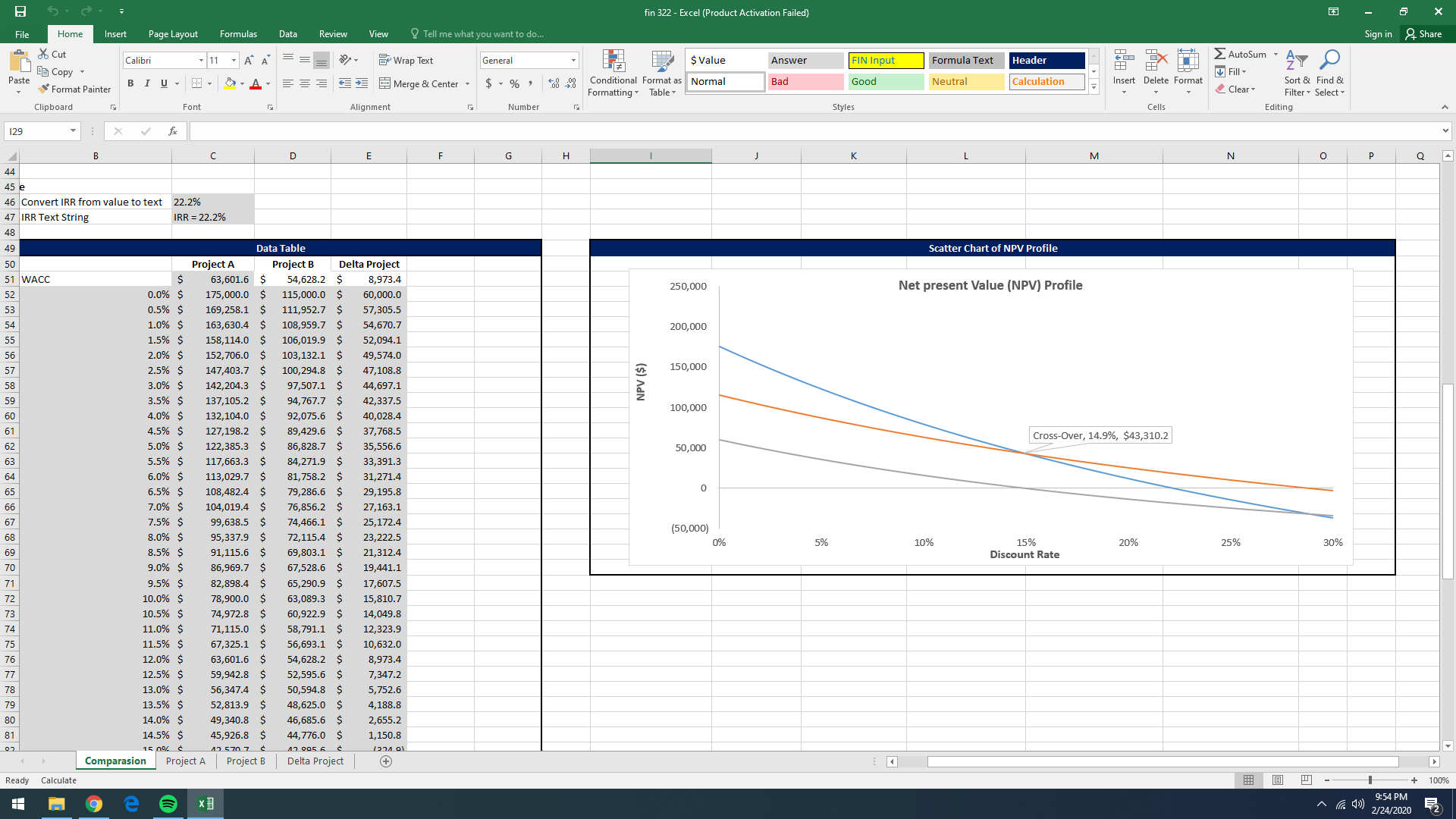

Question: Explain which project or projects you would accept or reject at what ranges of the discount rate. For example, between 0% and the cross-over point

Explain which project or projects you would accept or reject at what ranges of the discount rate. For example, between 0% and the cross-over point of ... %, I would choose project ... if mutually exclusive. Make sure you include all interesting ranges for the discount rate and cover both cases of whether the projects are mutually exclusive or not.

Important: Clearly mention the particular discount rates by their name (i.e. cross-over rate, WACC)andtheir percentage value and why you made the decision.

fin 322 - Excel (Product Activation Failed) X File Home Insert Page Layout Formulas Data Review View Tell me what you want to do.. Sign in & Share & Cut B Copy Calibri 11 . At A = = = Ex Wrap Text General $ Value Answer FIN Input Formula Text Header EX AutoSum . A Fill Paste Format Painter BIU - - LA E E Merge & Center $ - % " 08 4.8 Conditional Format as Normal Bad Good Neutral Calculation Insert Delete Format Sort & Find & Formatting * Table Clear Filter . Select Clipboard Font Alignment Number Styles Cells Editing 129 X V C D G H K M N O P Q 5 Cost of Capital 12.0% NPV $ 63,601.6 NPV 54,628.2 NPV $ 8,973.4 6 Payback Criteria .0 years IRR 22.2% IRR 29.0% Cross-Over Rate 14.9% accept 7 Payback 2.5 Years Payback 2.1 Years NPV Cross-Over A 43,310.2 accept 8 Year Discounted Payback 3.2 Years Discounted Payback 2.4 Years NPV Cross-Over B 43,310.2 accept Cash Flows Project A (275,000.0) $ 95,000.0 $ 120,000.0 $ 115,000.0 $ 120,000.0 Profitability Index 1.23 Profitability Index 1.34 10 Cash Flows Project B (160,000.0) $ 75,000.0 $ 80,000.0 $ 100,000.0 $ 20,000.0 MIRR 18.0% MIRR 20.5% 11 Delta Project S (115,000.0) $ 20,000.0 $ 40,000.0 $ 15,000.0 $ 100,000.0 12 13 iate Calculations 14 Intermediate Calculations - Payback 15 Year 0 16 Cash Flows (275,000.0) $ 95,000.0 $ 120,000.0 $ 115,000.0 $ 120,000.0 17 Cum Cash Flows (275,000.0) $ (180,000.0) $ (60,000.0) $ 55,000.0 $ 175,000.0 18 Payback 2.5 years 19 20 Intermediate Calculations - Discounted Payback 21 Year 0 22 Discounted Cash Flows 75,000.0 $ 80,000.0 $ 100,000.0 20,000.0 23 Cum Discounted Cash Flows in in (160,000.0) $ (160,000.0) $ (85,000.0) $ (5,000.0) $ 95,000.0 $ 115,000.0 24 Discounted Payback 2.1 years 25 26 Intermediate Calculations - Profitability Index 27 Year 0 28 Cash Flows $ (275,000.0) $ 95,000.0 $ 120,000.0 $ 115,000.0 $ 120,000.0 29 NPV of Future Cash Flows $338,601.6 30 Initial Investment S 275,000.0 31 Profitability Index (PI) 1.23 4 MIRR Function 35 Manual Calculations - MIRR 36 Year 0 Cash Flows (275,000.0) $ 95,000.0 $ 120,000.0 $ 115,000.0 $ 120,000.0 38 Outflows (negative cash flows) (275,000.0) $ $ 39 Inflows (positive cash flows) 95,000.0 S 120,000.0 $ 115,000.0 $ 120,000.0 NPV of inflows @ 12.0% $ 338,601.6 40 Present Value of Outflows (275,000.0) 41 Future Value of Inflows $532,796.2 42 MIRR (using RATE Function) 18.0% Comparasion Project A Project B Delta Project + Ready Calculate + 100% e x ]] 9:54 PM ~ (7