Question: Explain why diversification per se is not probably a good reason for merger. Answer ALL THREE (3) questions This contributes 50% to total assessment. Question

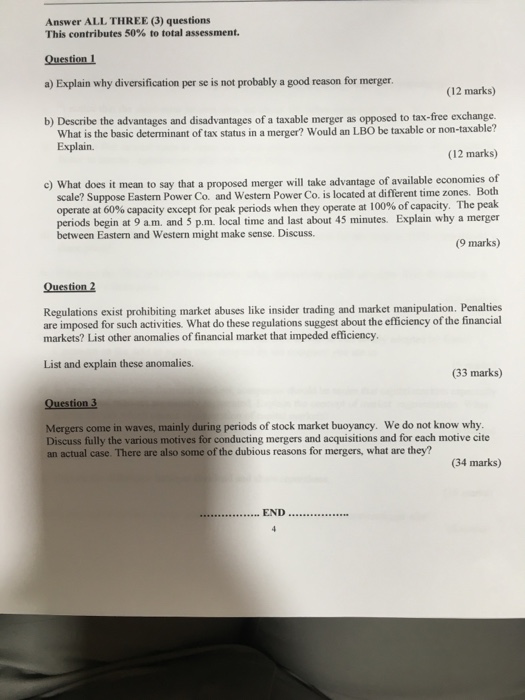

Answer ALL THREE (3) questions This contributes 50% to total assessment. Question 1 a) Explain why diversification per se is not probably a good reason for merger. b) Describe the advantages and disadvantages of a taxable merger as opposed to tax-free exchange. What is the basic determinant of tax status in a merger? Would an LBO be taxable or non-taxable? Explain. c) What does it mean to say that a proposed merger will take advantage of available economies of Suppose Eastern Power Co. and Western Power Co. is located at different time zones. Both operate at 60% capacity except for peak periods when they operate at 100% of capacity. The peak periods begin at 9 am. and 5 p.m. local time and last about 45 minutes. Explain merger between Eastern and Western might make sense. Discuss. (9 marks Question 2 Regulations exist prohibiting market abuses like insider trading and market manipulation. Penalties are imposed for such activities. What do these regulations suggest about the efficiency of the financial markets? List other anomalies of financial market that impeded efficiency. List and explain these anomalies (33 marks) Question 3 Mergers come in waves, mainly during periods of stock market buoyancy. We do not know why Discuss fully the various motives for conducting mergers and acquisitions and for each motive cite an actual case. There are also some of the dubious reasons for mergers, what are they? (34 marks) END

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts