Question: Explain why FedEx uses different methods of depreciation for financial reporting and tax purposes. Computing Depreciation and Book Value for Two Years Using Alternative Depreciation

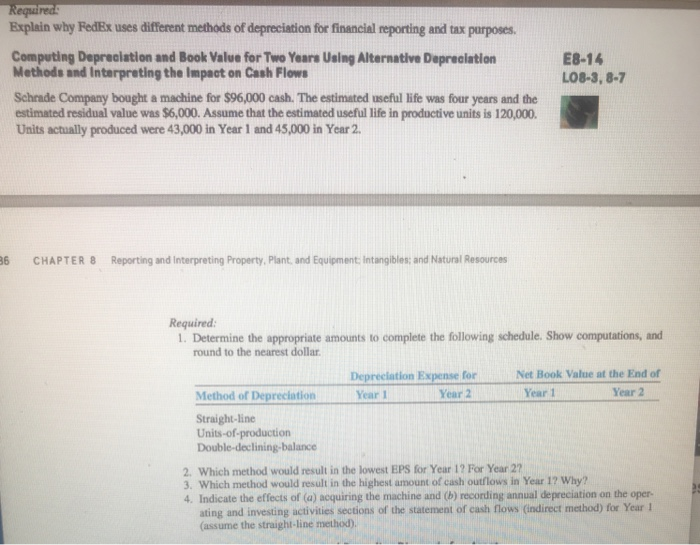

Explain why FedEx uses different methods of depreciation for financial reporting and tax purposes. Computing Depreciation and Book Value for Two Years Using Alternative Depreciation Methods and Interpreting the Impact on Cash Flow E8-14 LO8-3, 8-7 Schrade Company bought a machine for $96,000 cash. The estimated useful life was four years and the estimated residual value was $6,000. Assume that the estimated useful life in productive units is 120,000. Units actually produced were 43,000 in Year 1 and 45,000 in Year 2 6 CHAPTER 8 Reporting and Interpreting Property, Plant, and Equipment Intangibles: and Natural Resources Required 1. Determine the appropriate amounts to complete the following schedule. Show computations, and round to the nearest dollar Net Book Value at the End of Depreciation Expense for Year 1 Year 2 Year 1 Year 2 Method of Depreciation Straight-line Units-of-production Double-declining-balance 2. Which method would result in the lowest EPS for Year 1? For Year 27 3. Which method would result in the highest amount of cash outflows in Year 1? Why? 4. Indicate the effects of (a) acquiring the machine and (b) recording annual depreciation on the oper- ing andinvesting activities sections of the statement of cash fows (ndirect method) for Year (assume the straight-line method)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts