Question: Explain why it is important that this transaction be recorded correctly and what does it affect if the transaction is not recorded or recorded incorrectly.

Explain why it is important that this transaction be recorded correctly and what does it affect if the transaction is not recorded or recorded incorrectly. Transaction Payment of Expenses with Cash

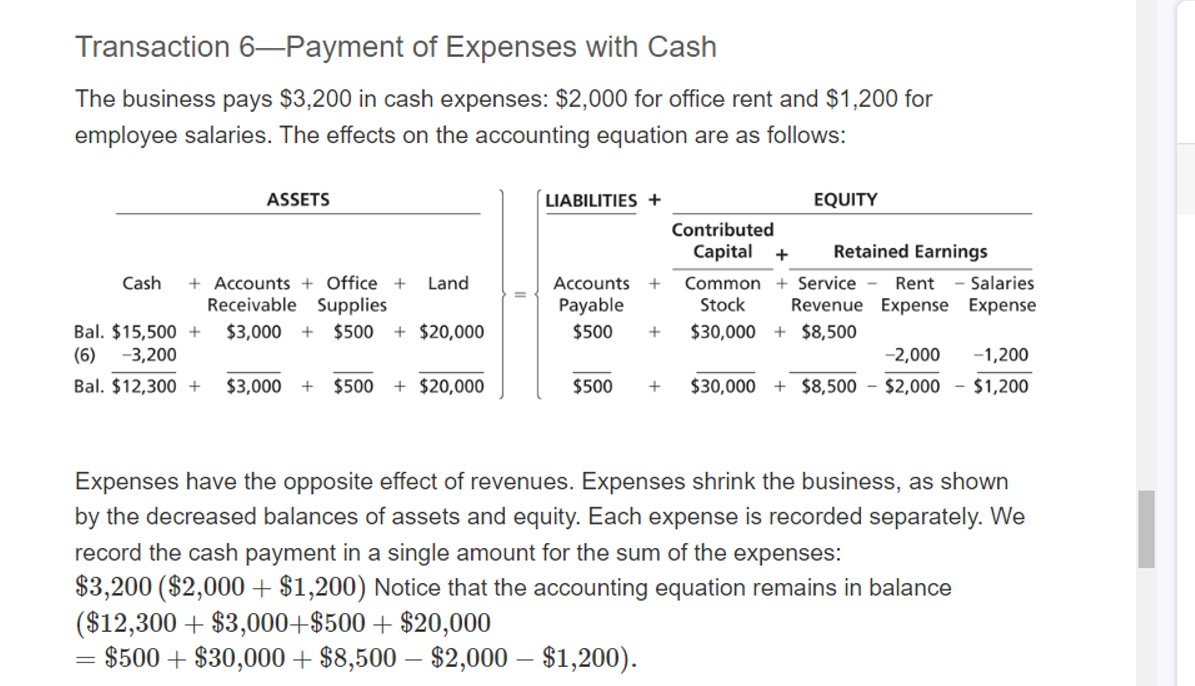

The business pays $ ?in cash expenses: $ ?for office rent and $ ?for employee salaries. The effects on the accounting equation are as follows:

Expenses have the opposite effect of revenues. Expenses shrink the business, as shown by the decreased balances of assets and equity. Each expense is recorded separately. We record the cash payment in a single amount for the sum of the expenses:

$$$ ?Notice that the accounting equation remains in balance

$$$$

$$$$$

Transaction 6-Payment of Expenses with Cash The business pays $3,200 in cash expenses: $2,000 for office rent and $1,200 for employee salaries. The effects on the accounting equation are as follows: ASSETS Cash + Accounts + Office + Land Receivable Supplies Bal. $15,500 + $3,000 + $500 + $20,000 (6) -3,200 Bal. $12,300 + $3,000+ $500 + $20,000 LIABILITIES + EQUITY Contributed Capital + Retained Earnings Common + Service - Rent Stock Revenue Expense Accounts + Payable $500 + $30,000+ $8,500 Salaries Expense -2,000 -1,200 $500 + $30,000+ $8,500 $2,000 - $1,200 Expenses have the opposite effect of revenues. Expenses shrink the business, as shown by the decreased balances of assets and equity. Each expense is recorded separately. We record the cash payment in a single amount for the sum of the expenses: $3,200 ($2,000+ $1,200) Notice that the accounting equation remains in balance ($12,300 + $3,000+$500+ $20,000 = $500+ $30,000+ $8,500 - $2,000 - $1,200).

Step by Step Solution

There are 3 Steps involved in it

The image provided shows an example of a transaction in accounting known as Transaction 6 Payment of Expenses with Cash This entry documents the busin... View full answer

Get step-by-step solutions from verified subject matter experts