Question: Explain why it is important to have diversification in a portfolio. The following table represents a portfolio of two (2) assets: State of Nature Probability

- Explain why it is important to have diversification in a portfolio.

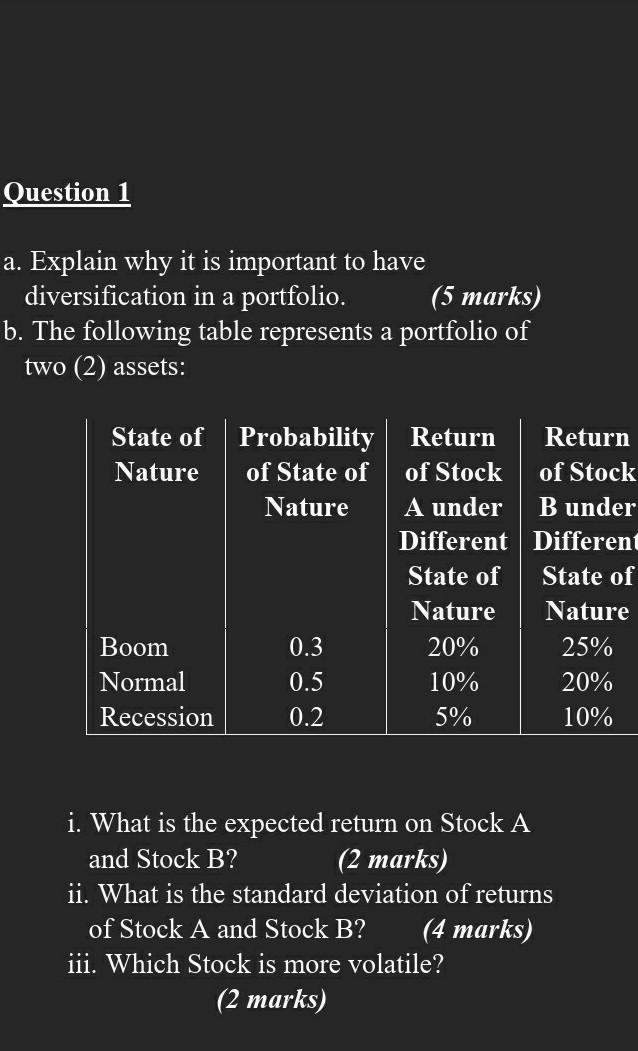

- The following table represents a portfolio of two (2) assets:

State of NatureProbability of State of NatureReturn of Stock A under Different State of NatureReturn of Stock B under Different State of Nature

Boom

Normal

Recession

0.3

0.5

0.2

20%

10%

5%

25%

20%

10%

- What is the expected return on Stock A and Stock B?

- What is the standard deviation of returns of Stock A and Stock B?

- Which Stock is more volatile?

E(ra) = Ri Pr

Variance = 2= ( Ri E(r)] 2Pr

Sd = =variance

CV= Standard deviation/ Expected return =/R

i. What is the expected return on Stock A and Stock B? (2 marks) ii. What is the standard deviation of returns of Stock A and Stock B? (4 marks) iii. Which Stock is more volatile? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts