Question: Explain with the aid of a numerical example using the yen per dollar exchange rate assuming a spot exchange rate of 120 yen per

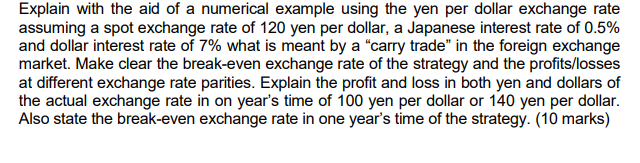

Explain with the aid of a numerical example using the yen per dollar exchange rate assuming a spot exchange rate of 120 yen per dollar, a Japanese interest rate of 0.5% and dollar interest rate of 7% what is meant by a "carry trade" in the foreign exchange market. Make clear the break-even exchange rate of the strategy and the profits/losses at different exchange rate parities. Explain the profit and loss in both yen and dollars of the actual exchange rate in on year's time of 100 yen per dollar or 140 yen per dollar. Also state the break-even exchange rate in one year's time of the strategy. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

A carry trade is a popular strategy in the foreign exchange market where an investor borrows money in a currency with a lowinterest rate and then uses ... View full answer

Get step-by-step solutions from verified subject matter experts