Question: explain your answer with the help of table and just focus on dividend policies. Q.No.2. The Omer Ltd and the Haider Ltd have had remarkably

explain your answer with the help of table and just focus on dividend policies.

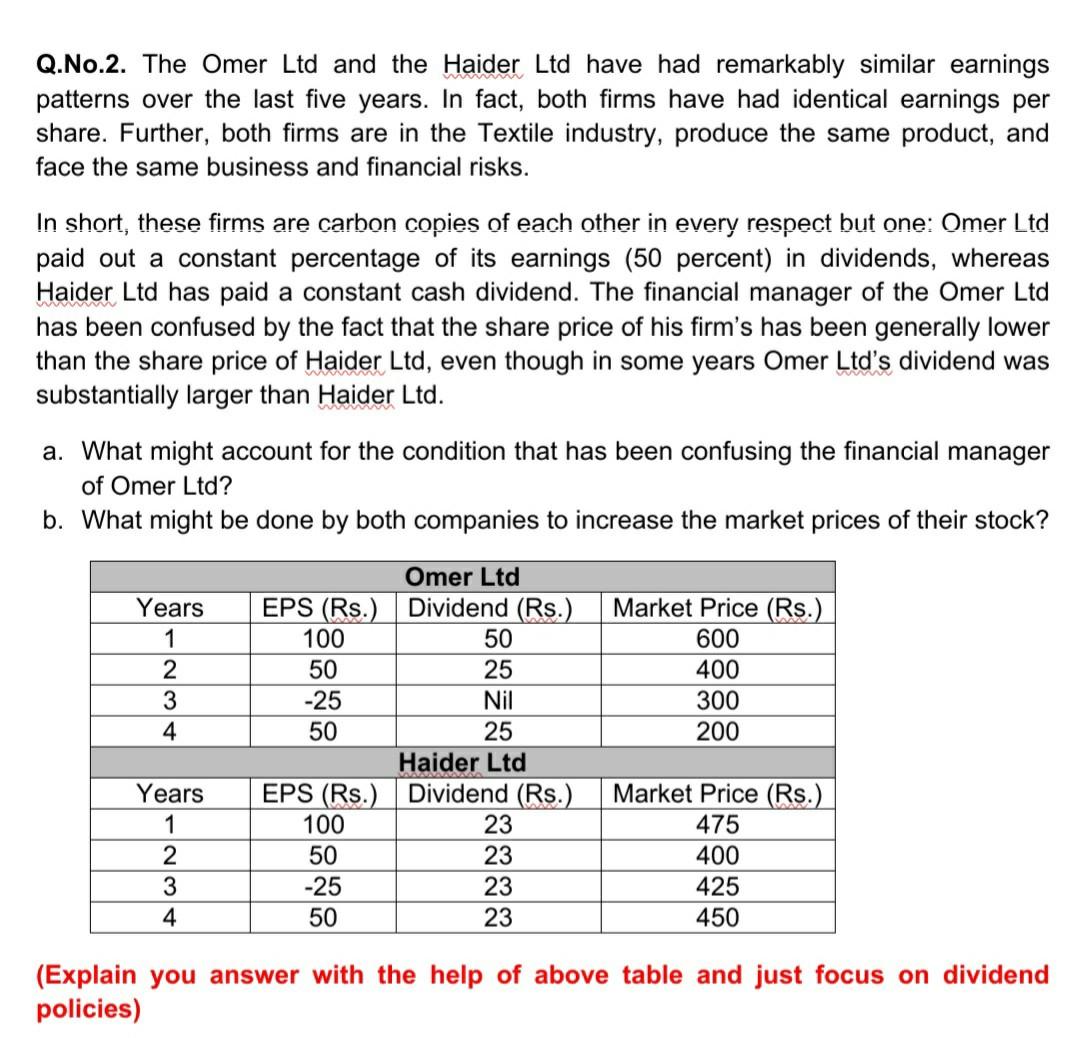

Q.No.2. The Omer Ltd and the Haider Ltd have had remarkably similar earnings patterns over the last five years. In fact, both firms have had identical earnings per share. Further, both firms are in the Textile industry, produce the same product, and face the same business and financial risks. In short, these firms are carbon copies of each other in every respect but one: Omer Ltd paid out a constant percentage of its earnings (50 percent) in dividends, whereas Haider Ltd has paid a constant cash dividend. The financial manager of the Omer Ltd has been confused by the fact that the share price of his firm's has been generally lower than the share price of Haider Ltd, even though in some years Omer Ltd's dividend was substantially larger than Haider Ltd. a. What might account for the condition that has been confusing the financial manager of Omer Ltd? b. What might be done by both companies to increase the market prices of their stock? Years 1 2 3 4 50 Market Price (Rs.) 600 400 300 200 Omer Ltd EPS (Rs.) Dividend (Rs.) 100 50 25 -25 Nil 50 25 Haider Ltd EPS (Rs.) Dividend (Rs.). 100 23 50 23 -25 23 50 23 Years 1 2 3 4 Market Price (Rs.) 475 400 425 450 (Explain you answer with the help of above table and just focus on dividend policies)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts